The typical Daily Update includes charts and forecasts for the S&P 500, Dollar Index, Euro futures, 30-year bond futures, crude oil futures, and gold futures.

Moving to new platform

This is just a reminder that we'll be posting all of our new content at tradingonthemark.substack.com starting today. If you're currently a subscriber to Trading On The Mark, you should have...

The Day Ahead: AM Edition 2021-02-12

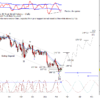

Alas the February 8th low in bonds turned into only being a very small degree three down from January 28th.

First Look: 2021-02-12

The S&P 500 futures fell initially overnight but have been rising this morning after they couldn't break under 3887.75.

The Day Ahead: PM Edition 2020-02-11

Bonds started higher on the day but ran into old support turned resist at 168^04 to 167^29 and fell away from in to have a down day.

The Day Ahead: AM Edition 2021-02-11

Bonds have held up as expected though slowing as it runs into the first extension targets up.

First Look: 2021-02-11

The rise in S&P 500 futures overnight has weakened the case for the high having been set yesterday.

The Day Ahead: PM Edition 2020-02-10

Bonds tested support at 166^22 today and pushed up over 167^12 and thus are on plan.

The Day Ahead: AM Edition 2021-02-10

Bonds are trying to wake up but there is work to be done.

First Look: 2021-02-10

S&P 500 futures pushed to test resist at 3928.75 on the CPI number this morning. Is that the high?

The Day Ahead: PM Edition 2021-02-09

Bonds poked briefly above 167^12 today before falling back to between that and 166^22.