REMINDER: Starting on Presidents’ Day weekend, Feb. 13-15, we’ll begin posting all updates at tradingonthemark.substack.com. If you’re already a subscriber to our service here, we’ll arrange to have your access continue there without interruption.

The Day Ahead: AM Edition 2021-01-15

Bonds are doing a fair job trying to make a higher lower at 168^03 stick and rise in the early stages of wave III up.

First Look: 2020-01-15

Well, the drop in S&P 500 futures in the afternoon yesterday and continuation overnight is acting like the aftermath of 'sell the news'.

The Day Ahead: PM Edition 2021-01-14

Bonds slipped lower today in what could be an effort to establish a higher low.

The Week Ahead: 2020-02-02

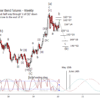

Bonds certainly were bid again last week as the corona virus fears hit the equity market but I am sticking to my view that this is a 'b' wave in development. The drop in bonds to the November low is just not convincing as the end of (b) as it is too shallow.

The Week Ahead: 2020-01-26

Bonds ended the week strong and are gapping up against the first of two targets for a deep retrace for a 'b' wave. I suggest this is a good place for a 'b' wave high and expect a trend to develop lower into May or June.

The Week Ahead 2020-01-19

Have had a request for an updated UNG chart listing next supports since it dropped through 16.03 this week so I thought I would put it here. Ideal cycle low this week with supports at 15.21 and 14.82.

Hit your targets

We believe an independent trader can succeed and profit in the markets, and we’re committed to helping our subscribers trade well on the time frame that best suits them. We founded Trading On The Mark in 2008 to help traders overcome some of the challenges of market analysis and trade execution. If trading futures and options based on technical analysis appeals to you, then you’re the kind of trader we want to work with.TOTM’s technical approach is grounded in Elliott wave and Gann techniques, while also making use of Fibonacci relationships in price and time, historical cycles analysis, proprietary technical indicators, and other more esoteric methods.

What people say about TOTM

If you love trading, I highly recommend Tradingonthemark! Tom, Kurt offer great charts and other technical stuff. It has improved my trading! — Moiz, intraday trader and long-time subscriber