REMINDER: Starting on Presidents’ Day weekend, Feb. 13-15, we’ll begin posting all updates at tradingonthemark.substack.com. If you’re already a subscriber to our service here, we’ll arrange to have your access continue there without interruption.

First Look: 2021-01-13

S&P 500 futures fell overnight to test the 3776.25 and have been rising since.

The Day Ahead: PM Edition 2021-01-12

Bonds started the day moving lower to test 167^16 then had a nice intraday reversal up that took it up through the 168^05 to 167^29 support range and just underneath old support at 168^31.

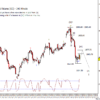

The Day Ahead: AM Edition 2021-01-12

Bonds slipped under 168^00 and pushed for the next target down at 167^15.

The Week Ahead 2019-12-29

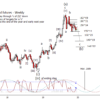

Since bonds have held the 155^11 support for the last three weeks, I'm now leaning toward a retest of resist, say 159^24, before breaking lower in the spring.

The Week Ahead 2019-12-23

Not much change last week in bonds as it traded in the range of the week before and is still holding above the 155^11 support. I suspect a week or two of bounce before breaking lower to at least test 152^25. This correction still strikes me as a little shallow for 'c of (b)' to be complete. I also think the cycles support lower for at least another month.

The Week Ahead 2019-12-16

Bonds have been trapped between resist at 159^24 and support at 155^11. I can't guarantee resist will not be tested again before dropping through 155^11 and at least testing 152^25. As it stands, this is too shallow to my eye for wave 'c of (b)' to be complete and cycles suggest the inflection is late January of next year at the earliest.

Hit your targets

We believe an independent trader can succeed and profit in the markets, and we’re committed to helping our subscribers trade well on the time frame that best suits them. We founded Trading On The Mark in 2008 to help traders overcome some of the challenges of market analysis and trade execution. If trading futures and options based on technical analysis appeals to you, then you’re the kind of trader we want to work with.TOTM’s technical approach is grounded in Elliott wave and Gann techniques, while also making use of Fibonacci relationships in price and time, historical cycles analysis, proprietary technical indicators, and other more esoteric methods.

What people say about TOTM

If you love trading, I highly recommend Tradingonthemark! Tom, Kurt offer great charts and other technical stuff. It has improved my trading! — Moiz, intraday trader and long-time subscriber