REMINDER: Starting on Presidents’ Day weekend, Feb. 13-15, we’ll begin posting all updates at tradingonthemark.substack.com. If you’re already a subscriber to our service here, we’ll arrange to have your access continue there without interruption.

The Day Ahead: AM Edition 2020-12-31

Bonds have indeed built a little base on top of 172^18 and now rising from it.

First Look: 2020-12-31

S&P 500 futures have been up this morning from a retest of the low from Tuesday morning.

The Day Ahead: PM Edition 2020-12-30

Again, very little real change in bonds today though not that surprising as it was the last full trading day of the year.

Japanese Yen Futures and ETF Update 2019-09-14

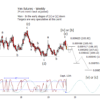

As you know, I have been critical of the rise in the Yen over the last month and continued to think it a developing wave [iv] or [b] triangle. Over the last three weeks that has been a strong reaction against resist at 0.009623. Certainly appears that prices are moving down in the early stages of [v] or [c] down out of the triangle. Supports on this chart are Gann based and while I think prices will react to them, it is very speculative at this point estimating where the turns will be in the five wave sequence. It is worth noting that the 'c of (e) of [iv] or [b]' terminated on a cycle inflection which implies a drop to the next in March of next year at a minimum and perhaps out to the following inflection next August.

The Week Ahead: 2019-09-08

Bonds are stalling just under resist at 167^07 but bears need to have price drop under 162^24 to rule out another stab at overhead targets. The indicators are somewhat mixed here as the cycles are pointing lower but the 9-5 study can accommodate another high. I can't be excited about higher but a little early to be seriously bearish.

Natural Gas via UNG Update

I have been looking for a possible wave (v) low in UNG for the last couple months and it looks like we may have one that sticks. It has spent the last few weeks up from a test, and brief poke under, support at 18.10. Goal now is to establish a five wave move up for an initial impulse up. Resist at 21.81 and 22.89 on the weekly chart. I'm working on the premise that the dominant weekly cycle is inverting and thus for a net rise into the end of the year.

Hit your targets

We believe an independent trader can succeed and profit in the markets, and we’re committed to helping our subscribers trade well on the time frame that best suits them. We founded Trading On The Mark in 2008 to help traders overcome some of the challenges of market analysis and trade execution. If trading futures and options based on technical analysis appeals to you, then you’re the kind of trader we want to work with.TOTM’s technical approach is grounded in Elliott wave and Gann techniques, while also making use of Fibonacci relationships in price and time, historical cycles analysis, proprietary technical indicators, and other more esoteric methods.

What people say about TOTM

If you love trading, I highly recommend Tradingonthemark! Tom, Kurt offer great charts and other technical stuff. It has improved my trading! — Moiz, intraday trader and long-time subscriber