REMINDER: Starting on Presidents’ Day weekend, Feb. 13-15, we’ll begin posting all updates at tradingonthemark.substack.com. If you’re already a subscriber to our service here, we’ll arrange to have your access continue there without interruption.

The Day Ahead: AM Edition 2020-11-12

Bonds have continued the bounce higher this morning but approaching resist at 171^21.

First Look: 2020-11-12

Yes, S&P 500 futures fell overnight to poke under support at 3545.00 but they did recover hence making it difficult for me to be bearish today while above 3545.00.

The Day Ahead: PM Edition 2020-11-11

Bond briefly poked lower to test the 169^17 support than spent the day rising.

The Week Ahead 2018-06-24

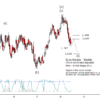

The grand theme that I have been operating under is that the S&P 500 and US equity indexes in general should have a rise into middle of June at a minimum and perhaps into the next cycle inflection at the end of August. If the S&P 500 had a completed five wave impulse to a test of or new high with this cyclic positioning, I would be claiming a high was being set. The wrinkle in the plan is that we don't have a test of the high nor a very satisfying formation. Up to this point I've been pounding the table for the prospects for higher but I'm going to pull in my horns a bit now. I still think it wise to allow for higher but prudent to manage any long positions you may have. After all, the Russell 2000 and Nasdaq 100 have made new highs over that of early this year and wouldn't be shocking to have intermarket divergences at the top.

The Week Ahead 2018-06-17

The equity markets took the FOMC rate hike well which I consider a positive for eventually getting a test or marginal new high in the S&P500. That said, it is worthwhile noting that the Russell 2000 and Nasdaq 100 have already made new highs over that of January this year satisfying the macro picture for a new high before a more serious correction process to begin. It also would not be shocking to see intermarket divergence where some indices make new highs and others make lower highs right before a serious downturn. Net, I think there is room for the equity market to extend but it is late in the game.

The Week Ahead 2018-06-11

This week is full of events that could either push the equity markets higher or pull the rug out from under them, the Singapore summit on Tuesday, FOMC on Wednesday, and ECB Thursday morning. My base hypothesis is the wheels will remain on even with a rate hike by the FOMC as long as it is accompanied by language that does not sound too hawkish for further hikes this year.

Hit your targets

We believe an independent trader can succeed and profit in the markets, and we’re committed to helping our subscribers trade well on the time frame that best suits them. We founded Trading On The Mark in 2008 to help traders overcome some of the challenges of market analysis and trade execution. If trading futures and options based on technical analysis appeals to you, then you’re the kind of trader we want to work with.TOTM’s technical approach is grounded in Elliott wave and Gann techniques, while also making use of Fibonacci relationships in price and time, historical cycles analysis, proprietary technical indicators, and other more esoteric methods.

What people say about TOTM

If you love trading, I highly recommend Tradingonthemark! Tom, Kurt offer great charts and other technical stuff. It has improved my trading! — Moiz, intraday trader and long-time subscriber