When a trader first discovers Elliott wave analysis, its rules can seem arbitrary or even mystical. For example, why does everything happen in three-wave and five-wave moves? Why is there a specific limit to how far a fourth wave can retrace along the span of the preceding three waves? Why are Fibonacci relationships so important in forecasting the distance price will travel?

In reality it’s not mystical, and it’s not arbitrary. Elliott wave charts are simply portraits of trader sentiment and crowd behavior in heavily traded markets. Every piece of an Elliott wave pattern makes a statement about what the majority of traders believe the future holds for a given market as well as their opinions and feelings about their own position in that market.

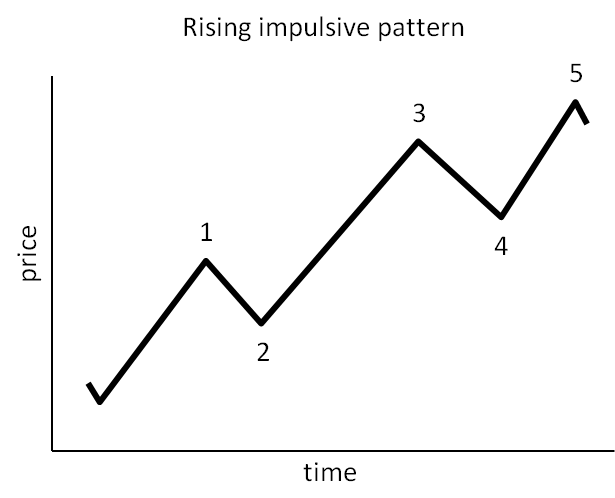

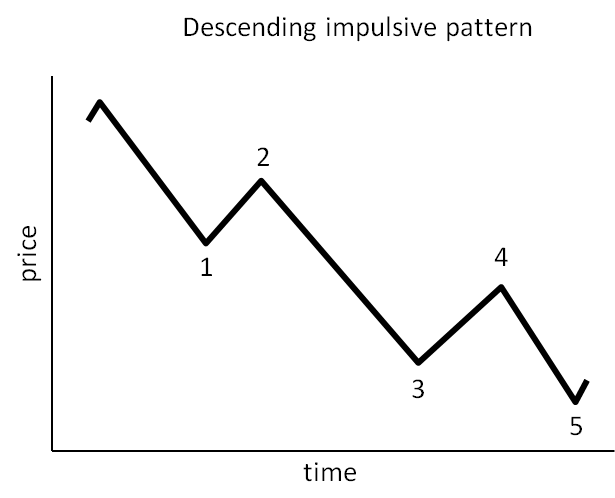

Impulsive patterns are one of the basic components of Elliott wave charts. They always consist of five waves. The illustrations below show how they typically look going up and going down.

Rules:

- In a rising impulse, the end of wave 2 cannot reach beneath the start of wave 1. In a declining impulse, wave 2 can’t reach above the start of wave 1.

- Among waves 1, 3 and 5, wave 3 can’t be the shortest. Wave 3 is typically the longest wave, but not always.

- Wave 4 can’t extend into the territory of wave 1.

Fractal nature: Within an impulsive pattern, wave 3 always takes the form of a smaller impulsive pattern. Wave 1 and wave 5 usually form small impulsive patterns, but sometimes they can form sometimes diagonal patterns, which are similar to impulses but involve more overlap among the sub-waves.

Waves 2 and 4 are never impulsive. Instead they can take any of several possible corrective forms. (On a smaller fractal scale there can still be impulsive components inside corrective forms.)

Understanding the sentiment behind each segment: Each segment of an impulsive pattern can be thought of as having its own character, reflecting a specific part of an “arc of sentiment” that traders in the market collectively go through during a market move. The price movement in each segment is created by traders acting on their sentiment, even though the traders don’t know with certainty what stage of the pattern they are in at any given time.

During the first wave, risk-tolerant traders recognize that the preceding move has reached exhaustion. They enter the market, thereby driving price up (or down) in a reversal move.

During the second wave, traders who rode wave 1 are taking profits, and there is uncertainty about whether the market can continue in the direction of wave 1. Meanwhile traders with a poor read on the market take positions believing the preceding pattern will allow for continuation.

During the third wave, more traders begin to recognize that wave 1 was the start of a real reversal. With every small retrace during wave 3, controlling sentiment has traders jumping in or adding to their positions in same the direction as wave 1. Extreme optimism (or pessimism) is a necessary ingredient for the third wave, and that’s why it is typically the strongest wave within an impulsive pattern.

The fourth wave is the embodiment of disagreement and uncertainty among traders about where the market is going. These factors often cause wave 4 to take a relatively complicated form.

- Some traders believe waves 1, 2 and 3 represented a three-wave correction that precedes a reversal.

- Some traders are still motivated by the excitement that produced wave 3, and they look for opportunities to enter what they believe will be continuation trades.

- The disagreement and uncertainty typically cause fourth waves to make a time-consuming series of back-and-forth moves, often within a converging range.

- Savvy traders who have a good read on the market recognize that the fourth wave will eventually end and produce a “break out” fifth wave going the same direction as the first and third waves.

The fifth wave represents a resolution to the uncertainty that produced the consolidation of the fourth wave. Price breaks out of the range of wave 4, which causes a rush of sentiment for more continuation trades. Meanwhile savvy and skeptical traders know that the fifth wave is unlikely to move as far as the third wave did. A fifth wave is always followed by either a retracement or a reversal.

This material © Trading On The Mark, 2019-2020. Reproduction or re-posting may only be done with the author’s permission.