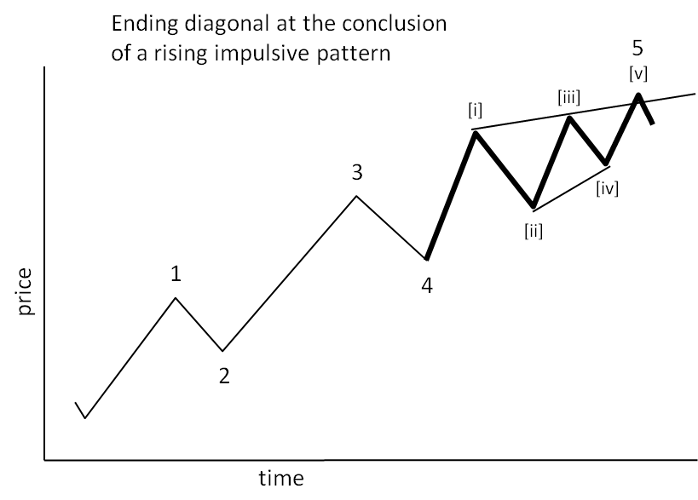

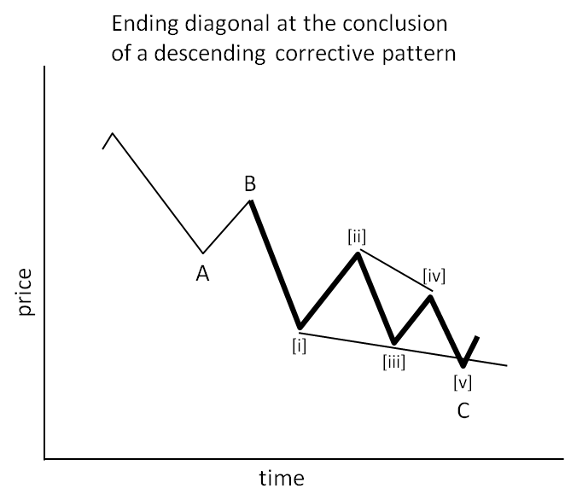

An ending diagonal pattern is a type of consolidation that can occur at the completion of a strong move. It reflects a “calming” of market sentiment such that price still moves generally in the direction of the larger move, but not strongly enough to produce an impulsive wave. It can be thought of as a terminal pattern, because it always precedes a reversal that is at least one order of magnitude larger than the ending diagonal pattern itself.

Ending diagonals can form at the conclusion of either rising or descending patterns in the following situations:

- Ending diagonals are found most often at the conclusion of an impulsive pattern, occupying the place of the fifth wave of the impulse.

- Sometimes an ending diagonal can occupy the place of wave ‘C’ in a three-wave corrective pattern.

Rules and tendencies:

- There is always overlap among the five waves inside the diagonal pattern.

- Nearly all ending diagonal patterns show a contracting range, which implies that wave [iii] must be shorter than wave [i], and wave [iv] must be shorter than wave [ii]. That tendency allows us to estimate boundaries for the pattern as shown in the illustrations, but we can be certain of the boundaries only in hindsight.

- Usually wave [v] of the diagonal concludes inside or near the boundary, which implies it is even shorter than wave [iii]. However sometimes the final wave can reach beyond the boundary to produce an “overshoot”, and wave [v] can even be longer than wave [iii] in some cases.

- In most cases, each wave inside an ending diagonal takes a corrective form. Typically each wave includes three sub-waves.

Understanding the sentiment: The five waves inside an ending diagonal reflect a waning of optimistic (or pessimistic) sentiment. Wave [iii] moves farther than wave [i] did, but it is nevertheless shorter than wave [i]. Ideally wave [v] reflects diminished sentiment compared to wave [iii].

On a fast time frame, an overshoot by wave [v] in the diagonal is usually a result of stops being hit, which causes price to continue briefly in the original direction. On a slower time frame, an overshoot represents a surge of enthusiasm or panic by the less savvy traders who still hold positions in either direction. Treating the fifth wave of a diagonal as a continuation trade can be quite risky.

This material © Trading On The Mark, 2019-2020. Reproduction or re-posting may only be done with the author’s permission.