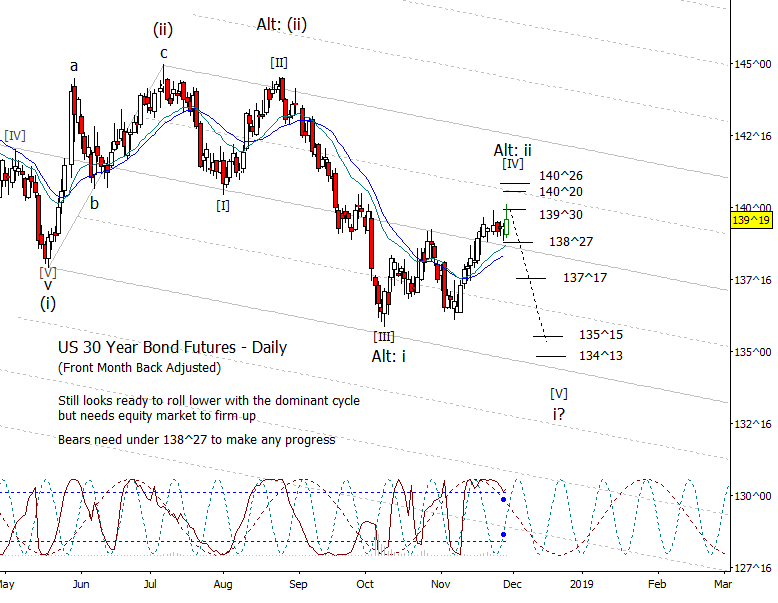

Bonds poked a new high today then fell back into the range of the last week. If this is a wave [IV], it is running out of runway as 140^26 is the limit. I still think it will roll down but it is being stubborn. First step is to fall under 138^27 which roughly corresponds to the daily moving averages. Perhaps we need to wait till December 4th which is the next fast cycle inflection before making much progress moving lower.

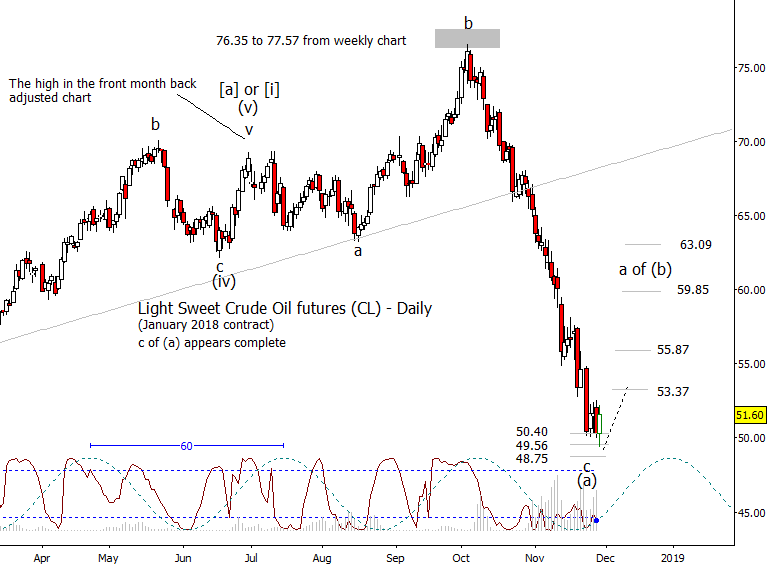

Crude started off under pressure once again dropping under 50.40 and testing 49.56 from where it staged a forceful recovery. Now to see if they can form a higher low intraday and continue the advance to test 53.37.

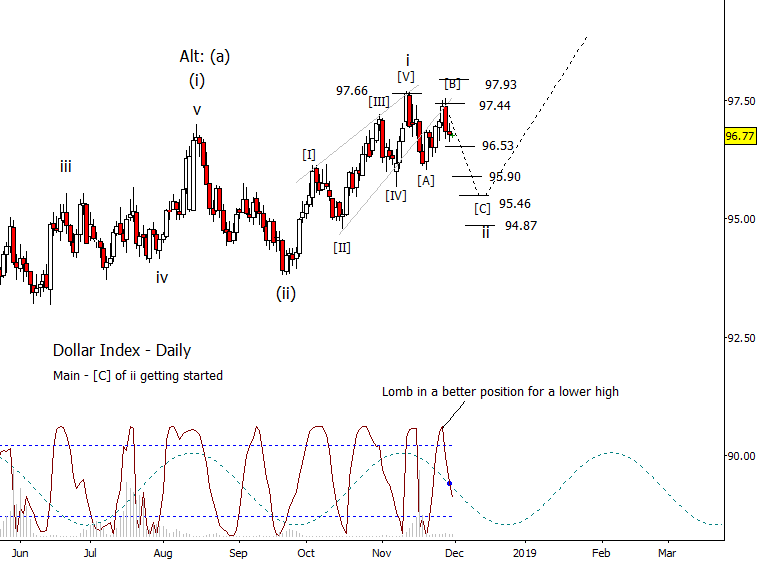

DX slowing as it approaches 96.53 is to be expected but do think it should be relatively soft support. Once 96.53 fails, perhaps after a small consolidation, a quick move to at least 95.90 should be next.

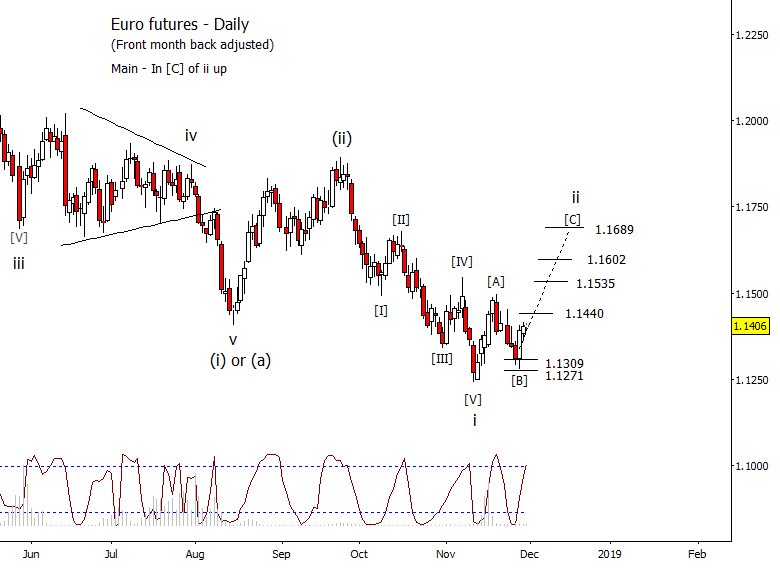

First test for the near term bullish Euro forecast is at 1.1440.

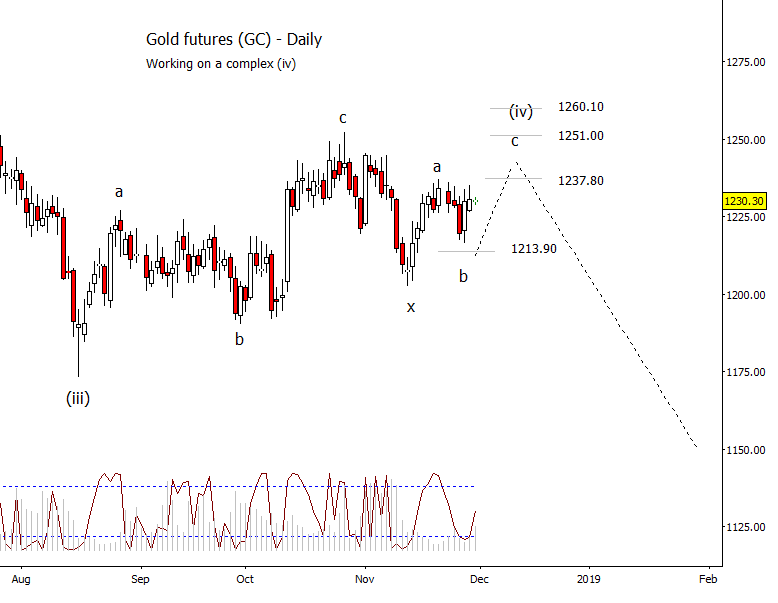

Expect gold to advance to retest the October high while DX retraces.

The S&P 500 did advance today but didn’t make it to 2762 though I still think that is the most important number in this area. Giving the bulls the benefit of the doubt to test it on Friday before forming a consolidation to see what happens at the G20 summit over the weekend.