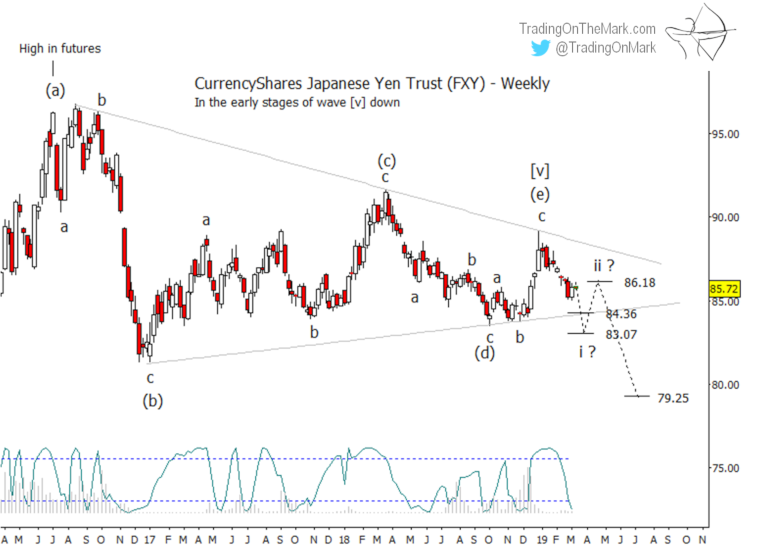

The Yen appears to be finished with the consolidation pattern that lasted from 2015 until the end of 2018. Now we believe it is ready to press to new lows in a way that should give traders multiple opportunities.

The Elliott wave triangle scenario we charted last August for the CurrencyShares Japanese Yen Trust (NYSEARCA: FXY) worked fairly well. Price initially poked slightly lower than we expected during the weeks following our post, but the expected upward reversal came through.

We noted specifically that “the upward retrace should find resistance if it tests the area near 89.87,” and indeed the bounce took price very near that level and also to a precise test of the trend line connecting previous FXY highs.

If the triangle is finished, then the next move should be a five-wave impulse downward. Sub-wave ‘i’ is probably already underway, and some Fibonacci-related targets for that sub-wave wait at 84.36 and 83.07.

The impulse should offer a tradable bounce as wave ‘ii’ and perhaps a lower-risk shorting opportunity. A nice target for a wave ‘ii’ bounce would be near the middle of the triangle’s range around 86.18, but it is not guaranteed to go that high.

A preliminary target for a stronger sub-wave ‘iii’ of the impulse sits at 79.25, also based on a type of Fibonacci calculation.

Follow Trading On The Mark on Twitter for more frequent updates about ETFs and futures! In coming days, readers of our free emailed newsletter will also receive exclusive content and opportunities to save on TOTM subscription packages.