As a reader of our free newsletter, we wanted to give you some fresh charts to show how well the Japanese Yen responded to the resistance we alerted you about in our August 12 email and our July 14 email. The levels worked well to produce a reversal trade.

There should be additional continuation setups coming soon.

We’ll start with an updated chart of the CurrencyShares Japanese Yen Trust (Symbol FXY) to show the geometry of the Elliott wave triangle or converging range. Then we’ll move to an exclusive Yen/Dollar futures chart showing how the forecast fits with one of the most prominent price/time cycles.

In July we indicated that FXY could press downward from its test of resistance near 89.24, and we revised the level slightly to 89.30 for the August email. Price tested and retreated somewhat from the resistance area and was consolidating just above the trend line that marks the upper boundary of the triangle shown.

If a trader was looking to enter short, but price had already retreated from first resistance, that would suggest using a downward breakout to signal trade entry. As you see, price did not break beneath the trend line but instead went back to re-test and exceed first resistance. At this point most traders should still have been flat, or at worst have been stopped out near first resistance.

FXY then went on to test the second resistance we emphasized at 90.41, which provided another opportunity for short entry with tight stops. So far, that trade is working well.

The rapid re-test of first resistance at 89.30 and the subsequent breakdown should encourage Yen bears to watch for signs of continuation. Next we would like to see FXY break beneath 87.55 and especially 86.71. The Fibonacci-related resonance level at 88.68 might also play a role as resistance if a bounce occurs soon.

The remaining levels on the chart at 85.61, 82.68 an 80.52 represent preliminary calculations for areas of possible turns based on a Fibonacci method. For now it makes sense to watch those levels in the context of FXY trying to make a five-wave impulsive move downward. We will be able to refine the levels after the impulse is a bit more mature.

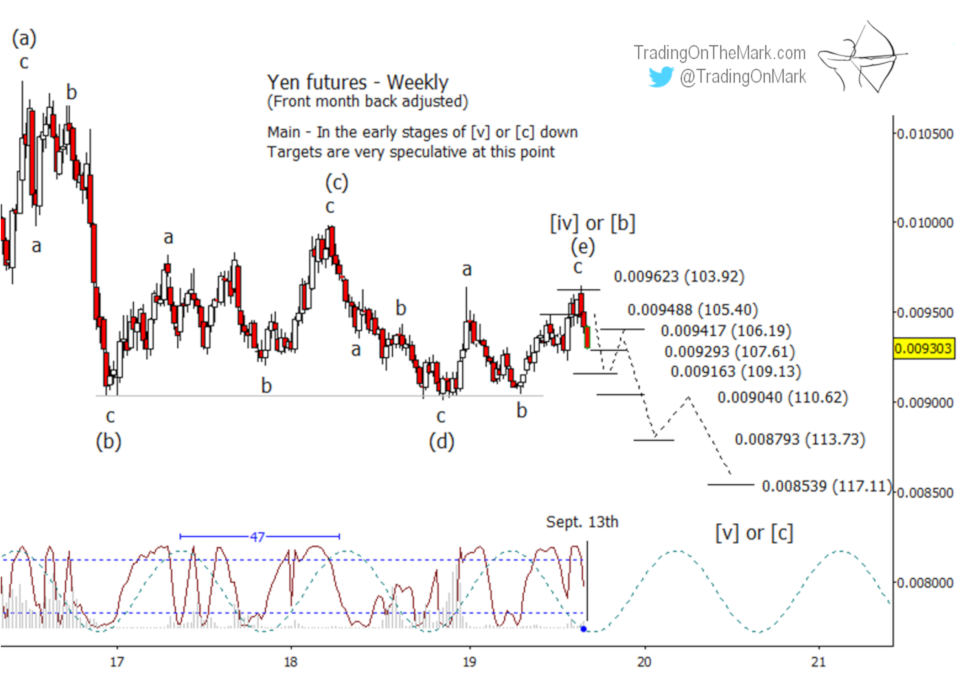

Turning to the futures chart, we see how the Yen made a similar test of the resistance we marked at 0.009488 (inverse 105.40) before consolidating. It then re-tested and overcame the level, only to find stronger resistance at the level we had marked at 0.009623 (inverse 103.92). The later resistance has produced a strong reaction that might be the expected reversal.

An inflection of the dominant 47-week price cycle and also the Lomb periodogram align with the idea of an August/September reversal. That and our primary Elliott wave count imply there should be downward continuation moves into 2020.

Some Gann-based price levels suggest preliminary areas that could be important during a downward cascade in wave [v] or [c] out of the triangle. They include: 0.009417 (inverse 106.19), 0.009293 (inverse 107.61), 0.009163 (inverse 109.13), 0.009040 (inverse 110.62), 0.008793 (inverse 113.73) and 0.008539 (inverse 117.11).