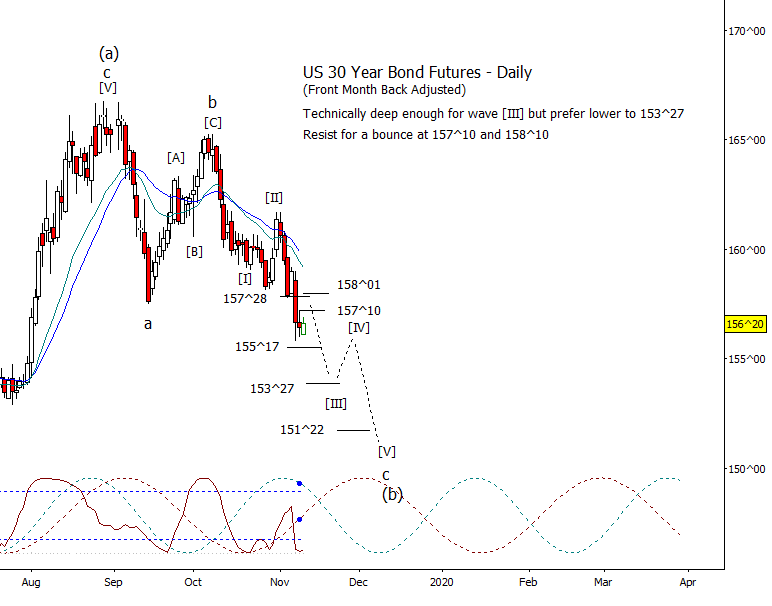

Bonds are forming a small consolidation under resists of 157^10 and 158^01 thus expect lower to at least 155^17 but probably lower to 153^27.

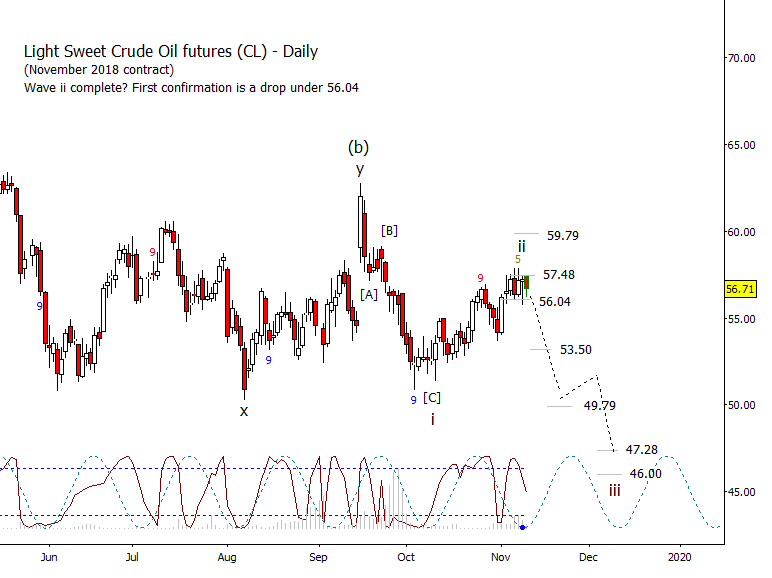

Crude is still being held back by 57.48 keeping alive my premise that we are seeing a cycle inversion, thus a high in prices, and will have a drop into the end of the month. The 9-5 exhaustion study supports this idea as it has printed a signal on Thursday of last week. Bears need to drop crude prices under 56.04 for confirmation.

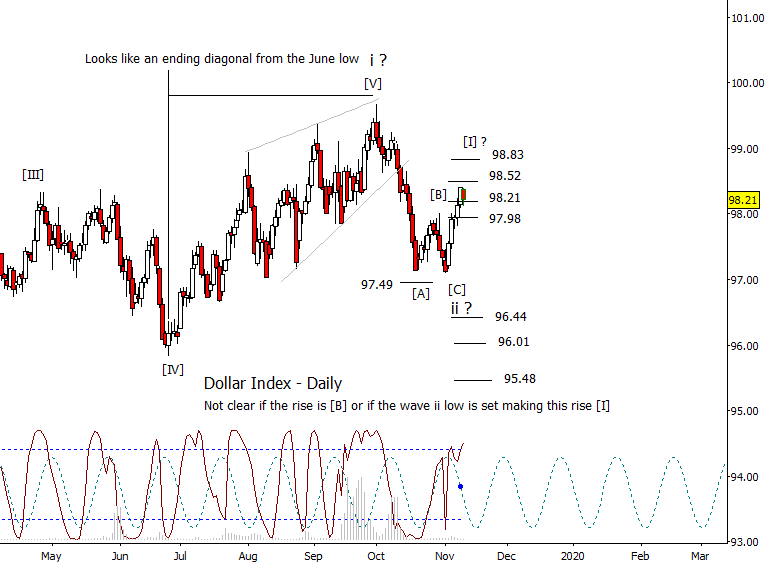

DX performing well by holding above old resist at 98.21. Still not clear if this is part of a [B] wave or [I] up. I’m giving the bulls the benefit of the doubt and expecting higher till the end of the week.

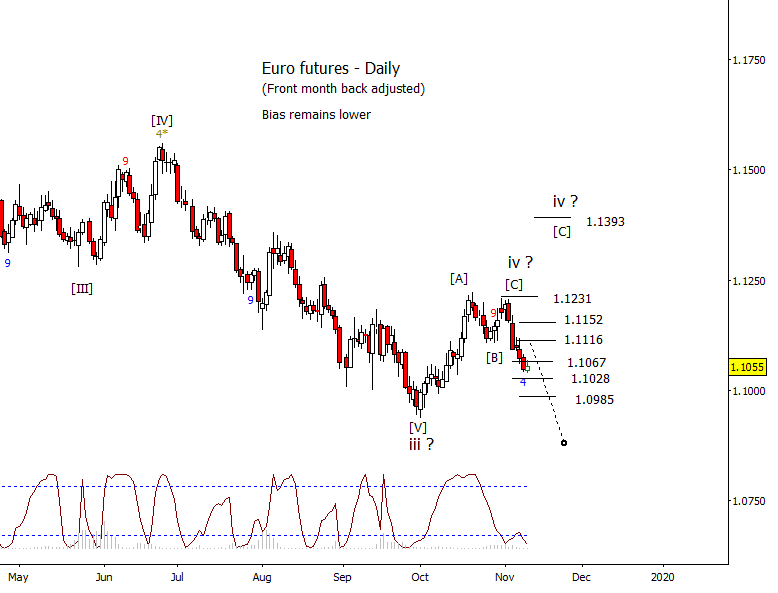

Euro bias remains lower as it is dropping through price projections. Next steps lower at 1.1028 and 1.0985.

I’ve changed my count in gold to a leading diagonal like count that would have wave iii nearly complete and due for a wave iv bounce soon. Short term support at 1446.25 and resist at 1465.69 and 1475.41.

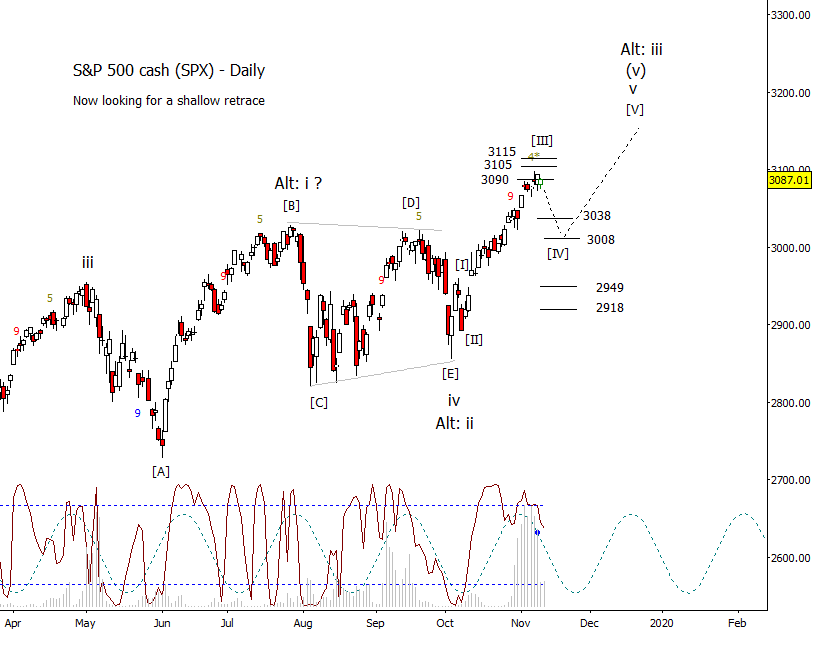

SPX thought about putting in a lower high today but failed to break down in a decisive way leaving the door open to 3105 or 3115. My hypothesis is that we get a retrace started fairly soon then a rally into the end of the year.