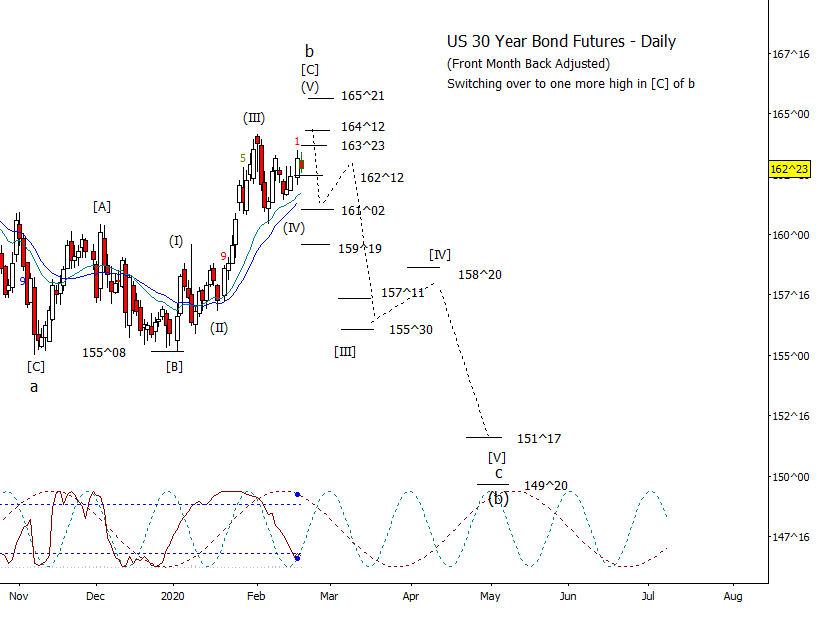

I know that I changed the main count in bonds over to one that calls for a test or new high to that of February third but the form so far looks pretty corrective post February 6th. I suppose it might turn into a tiny ending diagonal to reach up into 164^12 but if it drops under the daily moving averages at some point before a new high, I’ll switch back to wave ‘b” being set and work on getting a five count down into May or June.

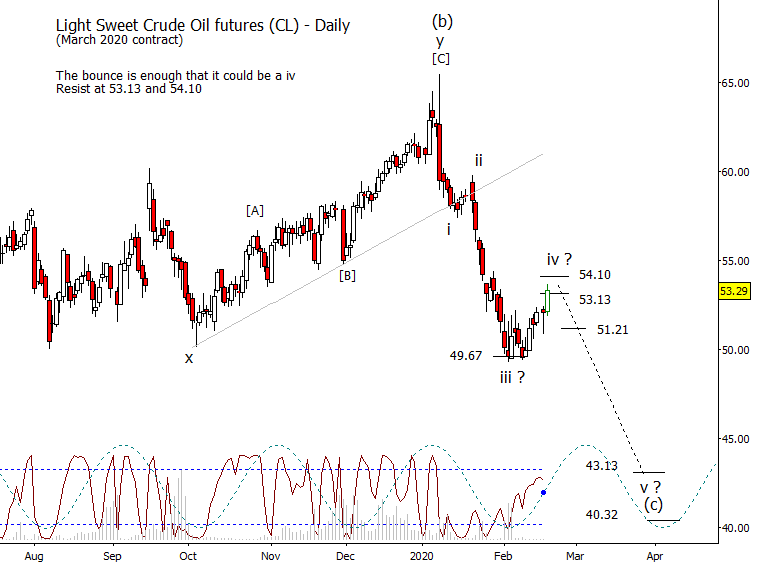

As much as I have reservations about the form from ‘ii’ to ‘iii’, the bounce is enough that we should consider this a possible ‘iv’. As to the cycle, perhaps a frequency doubling is taking place as the Lomb is predicting a cycle high relatively soon.

I’ve changed my DX count again, treating the move up this year as a [I]-[II] and now in [III]. Next two targets are at 99.72 and 100.37.

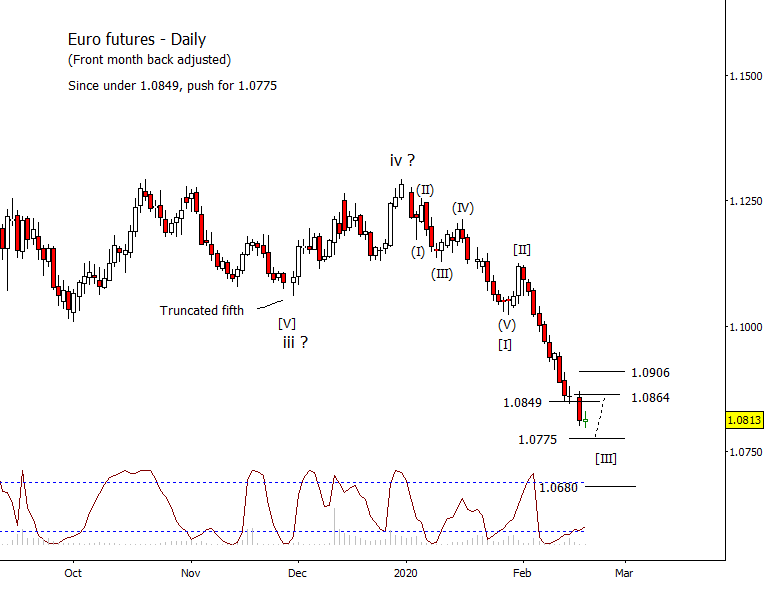

Euro is under 1.0849 but still short of the next wave [III] target of 1.0775 thus expect lower to test it before a bounce.

Gold rose to and just past the first of two targets for a small third wave at 1612.30 and 1623.70. Thinking we should see a small fourth wave retrace from nearby.

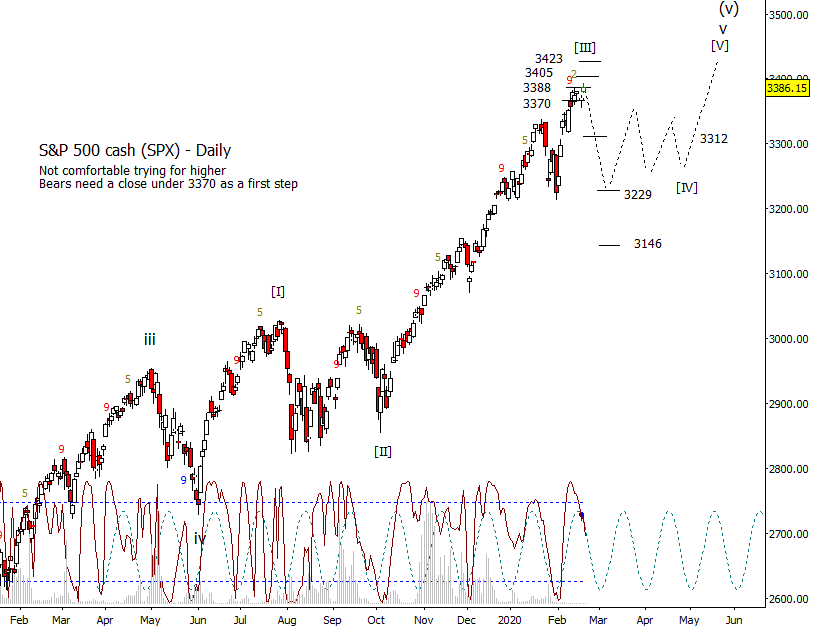

SPX trying to nudge closer to 3400. I think there are enough squiggles in the rise from January 31st low now to be complete. As I just checked the futures, I see they popped just a bit higher to 3397 and fell away from it 20 points.