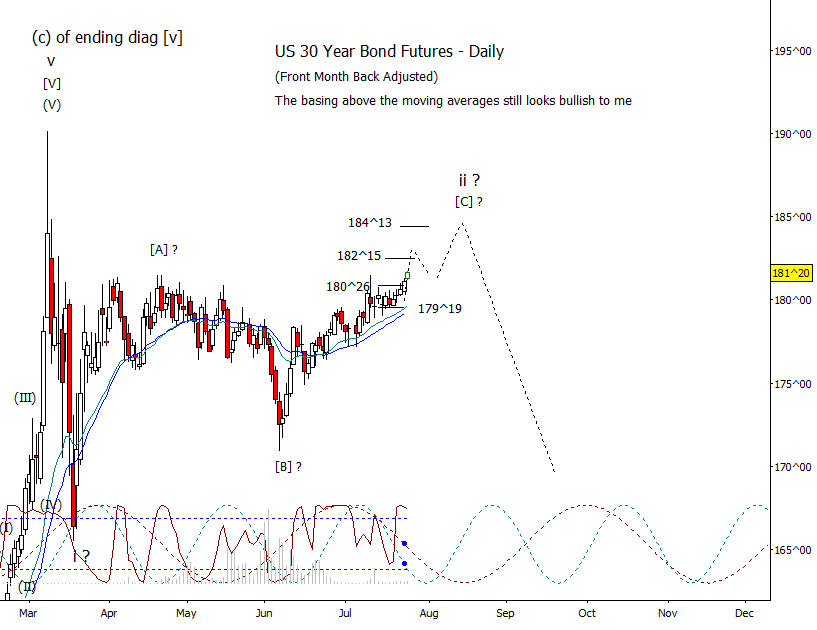

Bonds made good progress today pushing up over the April highs on the way toward 182^15 and 184^13.

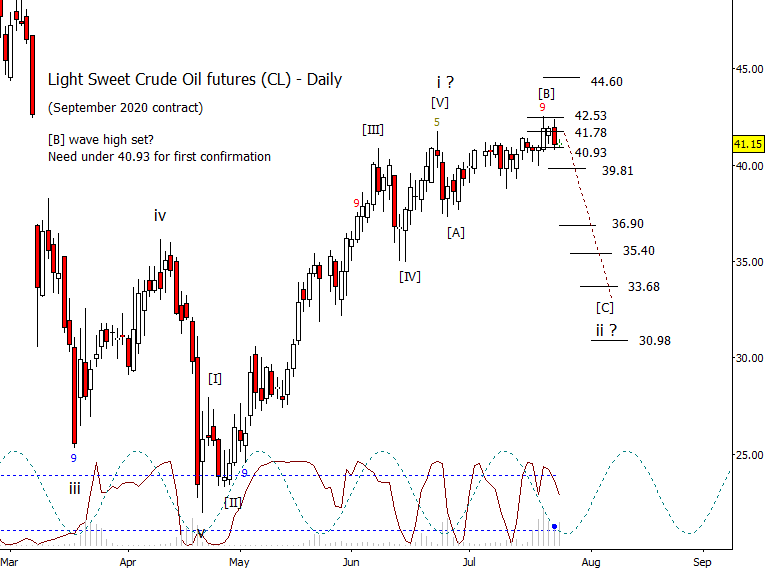

Promising move down today in crude but it couldn’t break under 40.93 which we need to see before getting too excited about finally getting the next leg down in the correction started.

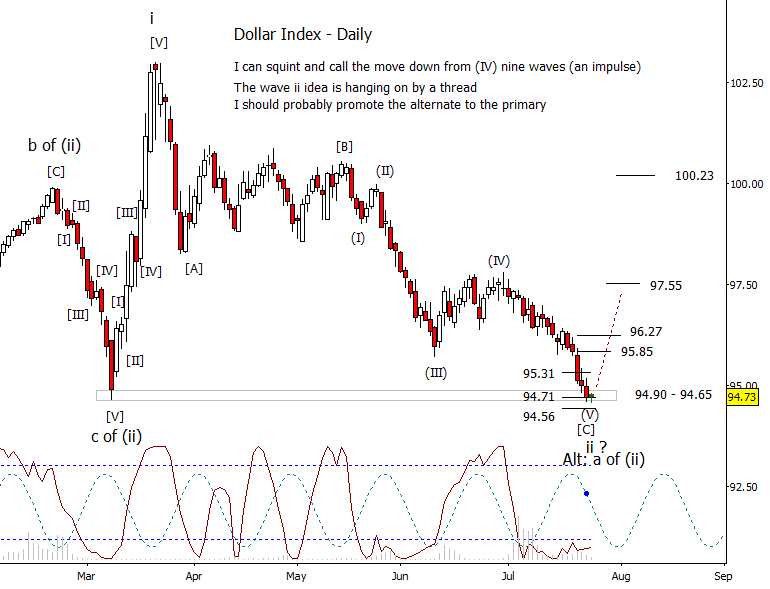

DX is trying to stabilize and move up from a test of the March low. First confirmation that a reversal is getting started is recovering 94.90 and eventually 95.31. Is the wave ii idea invalid? Technically by a fraction. As I mentioned yesterday, it is enough to change the sense of preference to the ‘a of (ii)’ and ‘ii’. I’ll change it on the chart over the weekend.

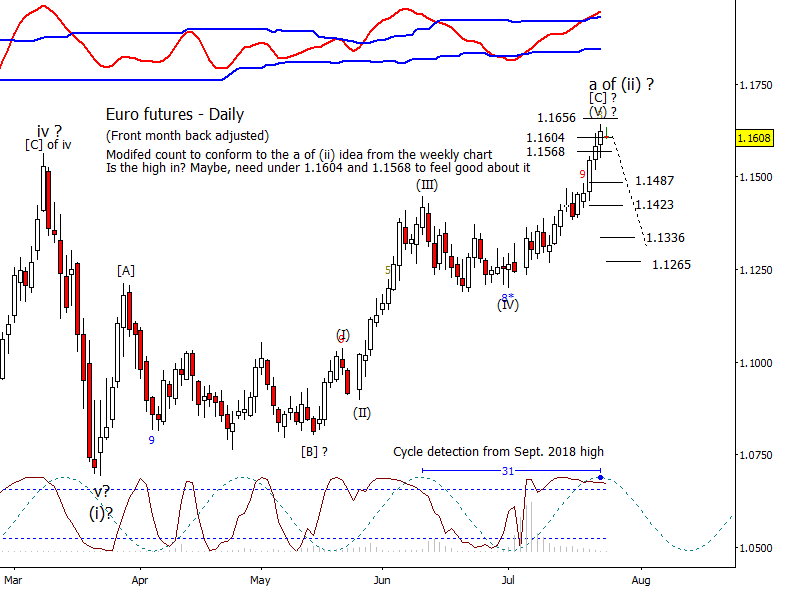

Nice move down in Euro on the intraday chart but need to see lower to feel confident that ‘a of (ii)’ has been set. Under 1.1604 and 1.1568 will increase the odds that a reversal lower in ‘b of (ii)’ is taking place.

Could the [b] wave high in gold be set? Maybe but need some confirmation. Under 1883.06 and 1854.45 are the first steps in turning the ship. Under the moving averages will be the first major step.

Could the reversal lower in a correction in SPX finally be starting? The dominant daily and weekly cycles say yes but we need to see supports to begin to fail. A lower start tomorrow would be a nice first confirmation even if it isn’t by much before consolidating ahead of the weekend.