In parallel with our suggestion that equities could be forming a top this month, we believe crude oil futures (CL) are due for a correction soon. The idea is consistent with the current oil glut, but we are looking mainly at the price charts.

To be clear, we don’t expect the low of spring 2020 to be tested again. That low probably represented the culmination of a five-wave ending diagonal decline that began in 2011.

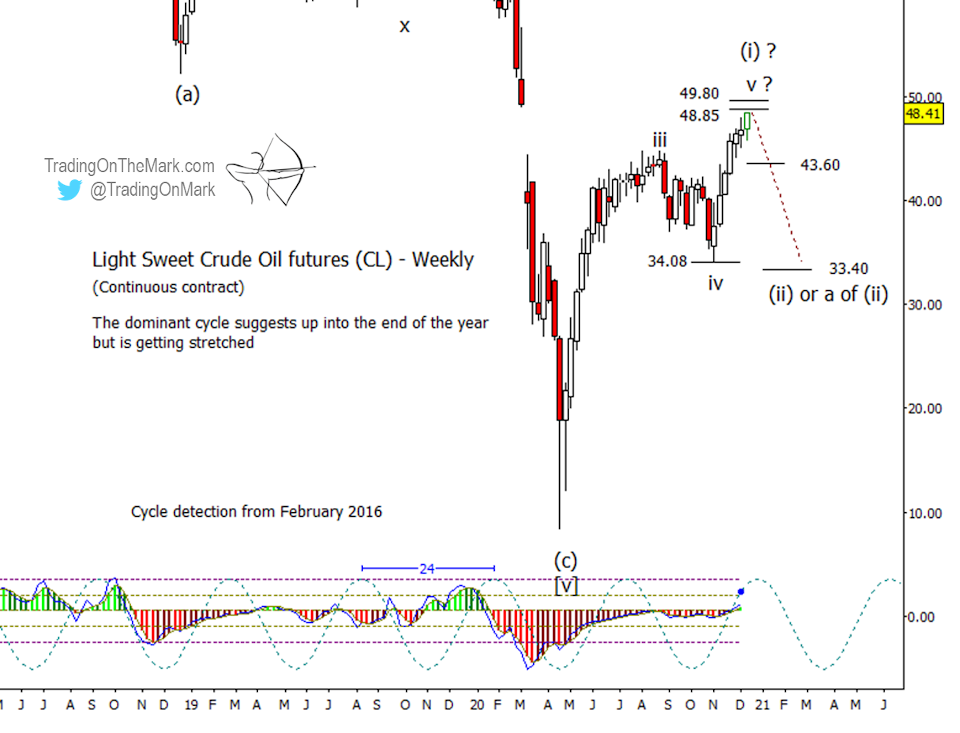

A diagonal decline is similar to the more common five-wave impulsive form, but each wave consists of three sub-waves. Thus, the final wave [v] is demarcated into sub-waves (a), (b), and (c), as shown in our monthly chart below. (You can read more about ending diagonal patterns here.)

The climb out of the April low probably represents the start of a new pattern segment. It has the steep character of an impulsive move and is similar to the price movement in the major equity indices since last spring. We count the upward moves in both equities and CL this year as impulsive.

On the weekly chart above, note that our preferred momentum indicator is testing its zero line – an event that often coincides with a price reversal. In addition the dominant 24-week price cycle has an inflection near the end of the year. This appears to be the set-up for a minor price high. CL is approaching our next resistance level of 48.85, and it might also try to close the gap left from March at 49.10. Above that is another Fibonacci-based resistance level at 49.80.

A break beneath 43.60 would serve as initial confirmation that a correction is underway. On our weekly chart we have indicated a fairly shallow correction. Support at 33.40 represents a good preliminary target for a retracement, although we might revise that target depending on the pattern that price forms during the next half-phase of the 24-week cycle.

As an alternative scenario, if price fails to reverse near the 48.85−49.80 area, it might push onward to test the next major resistance area near 62.90.