My premium content

Daily updates

The typical “Day Ahead” post includes charts and commentary for the S&P 500 Index (SPX), 30-year U.S. treasury bond futures, gold futures, Euro futures, crude oil futures, and the U.S. Dollar Index.

The Day Ahead 2017-11-24

Hope those of you in the US enjoyed Thanksgiving yesterday. The Friday after Thanksgiving is a shortened day ending at 13:15 EST. It also has a bias to the upside which by the look of the S&P 500 e-mini futures has came in on time with a new high.

The Day Ahead 2017-11-22

Many traders will have preparation for the upcoming holiday on their mind which would normally indicate a dull day. However, there is a fair amount of economic data today plus the FOMC minutes this afternoon at 14:00 so there might be some trading opportunity.

The Day Ahead 2017-11-21

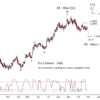

The S&P 500 is still being drawn toward the next round number at 2600. Pullbacks should be small until near the round number. In other markets, gold was interesting yesterday. Expectation has been that gold is consolidating before the next thrust lower and that may very well getting started.

The Day Ahead 2017-11-20

This week has the US Thanksgiving holiday on Thursday and a half day on Friday. The market usually tries to climb into the Friday after Thanksgiving. Good chance that the low this week is set this morning though they have one more shot at pushing lower depending on what they do with the next resistance zone around 2588 SPX. Equity futures were down early in the morning but have recovered the push down from the Sunday futures open. An attempt at a retest of the overnight futures low would be great but probably does not try that this morning.

The Day Ahead 2017-11-17

They decided to not only fill the first overhead gap but the second as well yesterday in the S&P 500. Today should be confined to a 10 point range between 2580 and 2590 SPX. The lower zone was tested in futures early this morning complicating the early morning trade somewhat as I don't know if it will be tested in the day session to get a cash print or just drift up from the cash open a few points higher.

The Day Ahead 2017-11-16

The S&P 500 was tricky yesterday, pushing toward the expected target zone quickly in the morning then testing 2570 SPX. Expecting a modest push over 2570 SPX today in an attempt to close the first overhead gap.

The Day Ahead 2017-11-15

The S&P 500 will likely start the day with a gap down and an open near 2570 SPX. Ideal to see a push lower from that area down toward 2562 or 2558 SPX. I certainly wouldn't mind to see lower in the...

The Day Ahead 2017-11-14

The S&P 500 indeed find an early morning low yesterday as expected but instead of only bouncing a few points and being trapped for the day, it pushed up to test the November 9th high. It still has the look to a lower high in the making and thus have a bias to lower. However, if 2578 SPX holds as support, a rally to attempt to fill the overhead gap is possible. Ideal in my view is that 2578 SPX is tested but only results in a shallow bounce.

The Day Ahead 2017-11-13 (Gold and Bonds)

Moving on from my technical difficulties, here are the gold and bond charts.

The Day Ahead 2017-11-13

The big picture in the US equity indices is that they can use a rest and form a consolidation pattern into early next year. Anything in the range of 100 to 200 S&P 500 points would not do serious damage to the trend up from early 2016.

The Day Ahead 2017-11-10

Nice follow-through lower yesterday in the morning to the expected target for the day but had a pretty steady recovery from the low into the end of the day which certainly complicates things. It would have made things easier for bears if they closed under 2580 SPX. That said, I am still going to treat this as a retest of the 2580-2588 zone that was lost yesterday. I think they are setting the market up for more decline next week.

The Day Ahead 2017-11-09

The S&P 500 did make an attempt to push up to test 2600 yesterday but fell just short of a new high. The S&P 500 futures did go on to make a new high over that of Tuesday early last night and have been under selling pressure since. I'm not interested in buying the pullback at this point. There may be a bounce today but favor selling retraces. If the close today is under 2580 SPX, we may finally have a more substantive retrace starting.

The Day Ahead 2017-11-08

The outlook for today is much the same as yesterday in the S&P 500. The market is being drawn toward the round number of 2600 but any misstep now that takes SPX under the previous target zone of 2580-2588 will mark possible reversal that can take the market at least 60-90 points lower. Short term, as much as I dislike it, I have to give the bulls the benefit of the doubt and let them try again for 2600.

The Day Ahead 2017-11-07

The S&P 500 seems to be determined to test the next round number at 2600. If that is their intention, a modest correction that holds above 2582 keeps the up trend intact and allows the market a brief rest to gain energy for a push to the round number.

The Day Ahead 2017-11-06

Now that the 2580's have been probed by the S&P 500, do they hold on in an attempt to test the round number at 2600? It is a possibility though in my view not required.

The Day Ahead 2017-11-03

The big picture idea in the equity indexes is the same as it has been for several weeks, that a modest sized correction is due.

The Day Ahead 2017-11-02

The S&P 500 pushed to a new high yesterday and fell away from it into the FOMC meeting. Is that enough? Is the swing high set? Maybe. I favor treating it as the high has been set though I can come up with a way to interpret the form from the October 30th low needing one last high. If the high has been set we should be looking at a 60-90 point correction over then next several weeks.

The Day Ahead 2017-11-01

Today we learn what the FOMC has to say about rate hikes and their balance sheet. I doubt they raise this meeting but all they need to do is make it sound like a hike at the December meeting is a lock to have the equity markets catch a cold.

The Day Ahead 2017-10-31

Last day of October and a day before we find out what the FOMC decides at the meeting that starts today. The general theme has been that the equity market holds up into tomorrow and is on track so far.

The Day Ahead 2017-10-30

The US equity market is probably in a holding pattern till the FOMC statement on Wednesday. S&P 500 futures are down overnight but that is in line with the small scale consolidation that we talked about in chat on Friday. Net, expect to see sideways motion today that might again push into the low 2580's SPX.

The Day Ahead 2017-10-27

The S&P 500 still behaves as if it has a date with 2580 or just above next week. A failure just under the present high would be ok, but think they will make it.

The Day Ahead 2017-10-26

With Euro, looking lower to either finish a fourth wave or it turns into the first impulse down from the high.

The Day Ahead 2017-10-25

Any small bounce or consolidation in bonds should be a selling opportunity. I believe we are seeing the market confirm that there will be a rate hike in December.

The Day Ahead 2017-10-24

So far, so good with the Dollar. It should aim for the 94.93 to 95.31 zone which is the next critical point for this advance. If they push through that zone we can say that the wave (iv) low has been set and expect at run up to at least the last high in the next year or two.

The Day Ahead 2017-10-23

If DX and Euro stay on course, no reason to believe gold will not push under the current October low.

The Day Ahead 2017-10-20

Crude holding above 50.70 is somewhat dangerous for the immediate bearish case.

The Day Ahead 2017-10-19

Yesterday I mentioned the possibility of gold forming a more complex wave 'ii' and it is still a concern though still suggest a bias lower on any bounce.

The Day Ahead 2017-10-18

More of the same that has taken place over the last two weeks. The S&P 500 flirts with a new high and falls back to test intraday support and spends the rest of the day attempting to recover....

The Day Ahead 2017-10-17

In response to a question in chat yesterday afternoon, I have marked on the S&P 500 chart projections from the last two major corrections, one that ran from late March into mid May, and from...

The Day Ahead 2017-10-16

2555 SPX has been difficult resistance for the market to overcome as there have only been brief pokes over in about two weeks. In general I see closes under 2555 as negative but the market has yet to fall away from this zone. Thus, have to allow for the next resist at 2559 to be tested. Net, same outlook as much of last week, I see this as an intermediate topping formation in development.

Other posts

(Public posts are included on this page too.)

British Pound futures 2017-11-23

Happy Thanksgiving! I thought I would see if I can sneak in a little analysis before slipping into a turkey induced coma.

Pullback nearly complete with British Pound ETF

We think it's time for the downward trend to resume

Copper ETF poised for downward move

A sizable downward correction is due

iPath Dow Jones-UBS Copper ETN (JJC)

I went ahead and did the copper analysis for the respective ETN. I've added some additional chart geometry and the Wave 59 9-5 study to the monthly chart but otherwise the story is the same as for copper futures.

Copper futures 2017-11-05

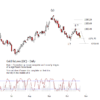

Up until the middle of next last month, I had been treating the rise in copper as a deep wave four but I am promoting the alternate to primary, an initial impulse up from the early 2016 low. That does not mean that I changed my mind about this advance ending, but that I have thrown in the towel on expecting a new low on a turn lower.

Gold futures 2017-10-31

I have been putting off a bigger picture gold post as I have been reevaluating the big picture EW counts. Let me start with the two scenarios I had been using and move on from there.

US 30 Year Bond futures 2017-10-22

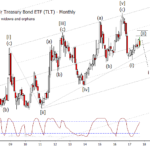

The bond charts look favorable for a move lower into next year. The alternate is that the wave (ii) is not yet finished though it is becoming a more distant possibility.

Natural Gas via (UNG) 2017-10-14

The outlook for UNG has not changed over the last few months. It has failed to rally much but then hasn't fallen either. Still favor a bounce that can test the highs from last year.

iShares 20+ Treasury Bond ETF (TLT) 2017-10-01

As you would expect, the analysis here is very similar to that done on bond futures earlier. This looks like a wave (ii) bounce though it is too early to rule out another test of overhead resistance.

US 30 Year Bond futures 2017-09-30

The major theme in bonds for the last six months has been that we are in a wave (ii) bounce after the first major impulse down from the 2016 high. A break of the low of last month should be the first major confirmation that bonds are ready to turn down.

Russell 2000 Index should correct soon, then climb

The index can climb still higher after a modest correction

Russell 2000 via (IWM) update

The theme from when I posted these remains the same from about a week ago. I just added the next steps up in the charts to keep an I on.

Russell 2000 ETF IWM 2017-09-24

The Russell 2000 is in a similar position as most of the other major indices. Probably in wave (iii) of [v] up from the 2009 low. This implies one more down/up move before any serious correction sets in.

Consumer Discretionary ETF still has upward potential

Counting an Elliott fourth wave in the upward progression

Wheat, Corn and the ETN JJG

To my eye, grains are in an ending diagonal or wedge in the latter stages of its development. Let us start with the ETN JJG which I think has the same ending diagonal form as wheat and corn but where a wedge is easier to see.

Natural Gas (via UNG) 2017-08-28

Updated weekly chart but very little change from the earlier post here which you should read as a reminder of the possibilities. The most noteworthy difference is that the cycle detection is focusing on a shorter cycle which has the ideal low at the end of September.

Consumer Discetionary ETF (XLY) 2017-08-26

I know that I just posted these last week but made slight changes to the targets on the weekly chart and think that the broader market is on the same path, closing in on a summer low.

Consumer Discretionary ETF (XLY) 2017-08-19

XLY is on plan correcting as expected. Can use a little lower over the next week or three to test ♦♦.♦♦ to ♦♦.♦♦ after which we see if they can muster enough energy to push to a new high, the main scenario, or if any bounce sets a lower high, the alternate.

Grains preparing for a breakout

We still believe a low is nearby, and this post explores some ways to trade it with the expectation of a bounce.

Copper futures 2017-08-12

I just can't get excited about this move up in copper as being the start of a major break higher. Instead, I still see this as the calm before the storm. Primary count is this being a wave (iv). I've marked the zone of overlap where wave (iv) would be invalidated. I can tolerate a brief spike into that zone but not a close.

Euro futures and ETF 2017-08-07

This is a post to consolidate the various Euro oriented charts that I have been working on over the last week or so. The main hypothesis is that this is a wave (iv) that is nearly complete. In this...

Euro ETF correction nearly complete

The Euro ETF has moved a bit higher than we anticipated in our June 16 post, but bears have a strong chance of countering the rally and taking price to new lows.

British Pound futures & ETF 2017-07-22

GPB has fallen from what I am calling a 'B' wave high in 2014 to a low early this year and been bouncing in a overlapping move to the present. Since the assumption that this drop is a 'C' wave, it...

Treasury yields TYX poised to grind upward

Now it appears that rates may be ready to begin advancing again.

Natural gas set to bounce

We are watching natural gas prices very closely right now. The technical picture makes a strong case to expect a reversal and rally soon.

Natural Gas via (UNG) 2017-07-10

The dominant weekly cycle in UNG is bottoming out now and starts to turn up into early 2018 making it interesting to see if a higher low or test of the previous 2016 low takes place over then next...

United States Oil Fund (USO) 2017-07-04

Since I have started to think that the low in crude is in, I thought I would update the charts for likely the most popular ETF for crude, USO. The monthly chart has a fork placed in a similar way to...

Crude Oil futures 2017-07-03

I had been expecting a new low from the bounce high in crude from late last year to develop this year. I had been treating that high as a wave four in an ending diagonal which calls for two motive...

Euro futures and Euro ETF 2017-07

The Euro moved up over first resist and now up against a deep retrace value and near a trend line. I am working with an ending diagonal for form. Depending on where wave (iv) ended gives solutions...

US Treasury 30 year yield (TYX) 2017-07-01

Over the last two weeks the yield made a brief poke under the .382 retrace of the advance from a year ago and recovered it this week. I continue to think yields rise though it does have to break...

Copper futures 2017-06-24

I'm skeptical that copper has found a lasting low but has yet to drop impulsively from resistance tested earlier this year. Prices have fallen from the channel and other resistance from February but...

Natural Gas via (UNG) 2017-06-18

In general, have been thinking that natural gas has been feeling its way to a higher low to that of 2016 and still think that is the case. The alternate count is that the late 2016 high was yet...

Euro futures and ETF 2017-06-17

Since the Dollar index is at an interesting juncture, it makes sense that the Euro would be as well. There is no change to the theme from the last time I posted the Euro charts, just minor changes...

US Treasury 30 year yield (TYX) 2017-06-11

Since we have the FOMC later this week, this seems an appropriate time to post these charts. Net, they are sitting on support and have a shot at testing 29.93 quickly with more after that. If they...

Dollar Index 2017-06-11

The dollar has been dropping from the start of this year. Does that mark the dollar high? I think not but do think that the advance is slowing and therefore not expecting dramatic gains. The main...

Trading the next move in treasuries

The choppy rise from the turn of the year appears to have been corrective, in this case meaning that it should be treated as a retracement.

Bears should resume watching this Italy ETF

Price starting to test the area that could prompt a breakout from the decade-long converging range.

Euro futures 2017-06-08

Just as I am skeptical that the US dollar has made the high, I think the Euro is near resistance that can take it back down. The Euro is near a .618 retrace of the last swing now along with other...

Watch this area for a Dollar UUP bounce

This is the right area to watch for a bounce in the Dollar and the UUP fund. View the latest chart at See It Market.

Crude Oil 2017-05-29

Crude has been stuck in a range for just over a year. I'm skeptical that the crude low has been set but in the bigger picture we should be in the endgame now. Any new low into the end of this year...

Copper futures 2017-05-29

The copper bounce up from early 2016 has stalled out at the top of a channel and leaking lower for the past few months. I am working under the assumption that February 2017 is the end of a...

US 30 Year Bond futures 2017-05-28

In the bigger picture, we have been expecting a net bounce in bonds since the end of last year into late spring or early summer to which the market has obliged with a choppy bounce thus far. Now we...

US 30 Year Bond futures 2017-05-22

Bonds stalling against 154^07 which is certainly promising but need 152^29 to fail before becoming too excited. You must be logged in as a Daily Analysis or Intraday Analysis subscriber to view the...

Natural gas via (UNG) 2017-05-19

When I last posted on UNG, we were looking for lower into the daily cycle low and a weekly inflection. Prices have consolidated since then but have failed to pullback much. This behavior can be...

Dollar Index 2017-05-17

The Dollar has been dropping but think it is too soon to declare the dollar rally up from the 2016 low to be over. Until the dollar is under 96.50, it is premature to think the rally up from the...

Wheat futures 2017-05-15

I've had a request to look at grains and have been dragging my feet about it because I don't have a strong opinion on the EW structure. Short term looks weaker but perhaps not much so and worth...

Copper futures 2017-05-14

The 2016 bounce in copper ran into resistance from various channeling techniques early this year and has been drifting lower since. I remain skeptical that a significant low has be set in copper,...

Watching for a short in the Yen

The modest rally in the Yen that we predicted in our February post has advanced nicely. Now price is approaching the area we have been watching for a downward turn.

The British Pound rallied as expected. What’s next?

Last week's spike in the British Pound caught some traders off guard, but if you have been following our posts at See It Market you were prepared for it.

Yen futures and ETF (FXY) 2017-04-27

The yen has been moving up the first part of this year as expected but should be nearing an inflection either in May or June. The ideal cycle high is in June but we need to be alert for a high...