My premium content

Morning & evening updates

We chart the S&P 500, crude oil, the Euro, Dollar Index, treasury bonds, and gold, typically with a morning and evening post for every trading day.

The Day Ahead: AM Edition 2021-01-29

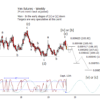

Bonds soft yet again as bears try to treat the rise from January 12th as simple a-b-c correction up.

First Look: 2021-01-29

S&P 500 futures have been soft overnight but held important support around 3723.00.

The Day Ahead: PM Edition 2020-01-28

Bonds had a bit more of a stutter than I expected today but held where it needed, 169^05, and recovered 169^19.

The Day Ahead: AM Edition 2021-01-28

Bonds were due for a retrace and it certainly kicked in today. I'm thinking a wave IV.

First Look: 2021-01-28

S&P 500 futures rose as expected from 3710.50 overnight.

The Day Ahead: PM Edition 2021-01-27

Bonds are navigating the interference from the daily moving averages well.

The Day Ahead: AM Edition 2021-01-27

Bonds have a small five wave sequence up from the January 21st low which implies a corrective move is due.

First Look: 2021-01-27

With this much drop overnight in S&P 500 futures, I'm leaning to the high was set yesterday.

The Day Ahead: PM Edition 2020-01-26

Pretty much what I expected in bonds today as they hug the daily moving averages.

The Day Ahead: AM Edition 2020-01-26

Bonds slowing the advance a bit but think there can be one more minor advance before a slightly larger retrace.

First Look: 2020-01-26

So far the S&P 500 futures are staying on plan with moving higher this morning after a minor retrace.

The Day Ahead: PM Edition 2020-01-25

Bonds made it up to the daily moving averages today but short of resist at 170^15.

The Day Ahead: AM Edition 2020-01-25

Bonds finally pushing up from the 168^06 support today.

First Look: 2020-01-25

The S&P 500 500 futures held up pretty well overnight suggesting a push to a new high later today or tomorrow.

The Day Ahead: AM Edition 2021-01-22

Bonds now trying to again lift from a retest of support around 168^06.

First Look: 2021-01-22

That late day weakness bled over into the overnight and early morning as expected in the S&P 500 futures.

The Day Ahead: PM Edition 2021-01-21

Bonds fell back again to test the bottom end of the range it has been stuck in for the last week.

The Day Ahead: AM Edition Addendum

I've been asked to add something S&P 500 related to the The Day Ahead: AM Edition posts.

The Day Ahead: AM Edition 2021-01-21

Bonds are retesting the bottom of the range this morning.

First Look: 2021-01-21

S&P 500 futures advanced overnight and have started a little soft this morning in the day session.

The Day Ahead: PM Edition 2020-01-20

Little movement in bonds today though again think it a minor positive that they held up while the equity indices advanced.

The Day Ahead: AM Edition 2021-01-20

Not much change in bonds. I think it a minor positive to hold up while the equity indices are making new highs.

First Look: 2021-01-20

S&P 500 futures staying on track by moving higher overnight.

The Day Ahead: PM Edition 2020-01-19

Bonds sticking to plan so far, working on holding a higher low.

The Day Ahead: AM Edition 2021-01-19

Bonds still trying to hold 168^03 and 168^12.

First Look: 2021-01-19

S&P 500 futures are looking positive for at least a retest of the high if not a new high just und 3850.00.

First Look: 2021-01-18

S&P futures held a retest of the Friday low and have been rising since.

The Day Ahead: AM Edition 2021-01-15

Bonds are doing a fair job trying to make a higher lower at 168^03 stick and rise in the early stages of wave III up.

First Look: 2020-01-15

Well, the drop in S&P 500 futures in the afternoon yesterday and continuation overnight is acting like the aftermath of 'sell the news'.

The Day Ahead: PM Edition 2021-01-14

Bonds slipped lower today in what could be an effort to establish a higher low.

Weekly updates & other posts

(Public posts are included on this page too.)

The Week Ahead: 2020-04-12

Nice rejection of 182^14 in bonds last week.

The Week Ahead: 2020-04-05

Still looking for a lower high to form in bonds relatively soon.

The Week Ahead: 2020-03-29

Base assumption in bonds remains unchanged, that the high of the large ending diagonal is in and now waiting for a lower high to form.

The Week Ahead: 2020-03-22

No doubt another crazy week ahead but I still think that crude is nearing a significant low which should help the indices stabilize.

The Week Ahead: 2020-03-15

The Fed jumps in early, not waiting till Wednesday, and cuts interest rates. BoJ is also bringing forward their scheduled meeting from later in the week to Monday. No doubt another volatile week.

The Week Ahead: 2020-03-08

Certainly going to be an eventful week as the S&P 500 futures are limit down as I type and crude fell through initial supports in the high 30's and now even slightly under the next major support zone of 32.40 to 31.10.

Japanese Yen Futures and ETF Update

After this recent rally in Yen I've been asked for an update of Yen Futures and the ETF FXY.

The Week Ahead: 2020-03-01

I'm going to mix up the order a little this week as I have been working on equity indices this afternoon thus will start with them.

The Week Ahead: 2020-02-23

I'm adjusting my bond count up from the 2018 low from 'a-b' up in 'c of (a)' for a three wave move for (a) to one of an impulse, a five wave move. Note the areas I marked as 1) and 2) for the implications. I just can't go with the retrace from the August high as a wave (b) because it was so shallow which then implies it was a fourth and moving up in the late stages of 'v of (a) of ending diagonal [v]'. Minor target at 165^01 tested already, next at 167^23 though a retest of the prior is good enough. A drop back under previous resist at 162^28 would be first confirmation of falling back in the first swing of (b).

Japanese Yen Futures & ETF FXY Update

Yen appears to be accelerating lower after the minimal retrace made when I last updated this chart a few weeks ago. I'm assuming this is the early stages of (iii) of [v] or [c] down. Minor support being tested now at 0.008994 though I don't think it will be very firm. Prefer lower targets at 0.008789 or 0.008643 before a more substantial bounce.

The Week Ahead 2020-02-16

Monday is a US holiday thus no posts or chat. Regular posting schedule Tuesday morning.

The Week Ahead: 2020-02-09

Bonds are stalling up against resist for a possible lower high, a wave 'b', at 163^25. The Lomb Periodogram is projecting a cycle high here which corresponds with a cycle inflection of one of the weekly cycles. Bears need bonds under 161^11 for confirmation of a reversal.

British Pound & Yen Futures Update

In addition to the GPP and Yen ETF updates in the last Week Ahead post, I have been asked to update the futures as well.

The Week Ahead: 2020-02-02

Bonds certainly were bid again last week as the corona virus fears hit the equity market but I am sticking to my view that this is a 'b' wave in development. The drop in bonds to the November low is just not convincing as the end of (b) as it is too shallow.

The Week Ahead: 2020-01-26

Bonds ended the week strong and are gapping up against the first of two targets for a deep retrace for a 'b' wave. I suggest this is a good place for a 'b' wave high and expect a trend to develop lower into May or June.

Dollar fund poised to rise

There are already preliminary signs of a breakout

The Week Ahead 2020-01-19

Have had a request for an updated UNG chart listing next supports since it dropped through 16.03 this week so I thought I would put it here. Ideal cycle low this week with supports at 15.21 and 14.82.

Fishing for a natural gas low

Chart updated with additional supports

The Week Ahead: 2020-01-12

As expected, bonds have drifted back up to retest resist at 159^24. I favor 159^24 or 160^31 holding as resist and bond prices falling out the bottom of support at 155^11. The Lomb Periodogram suggests bond prices holding up for another week or two before breaking lower.

Natural Gas and UNG Update 2020-01-07

I'm going to use the weekly UNG chart for the big picture and then switch to the daily natural gas futures chart for the fine details.

The Week Ahead 2020-01-05

I've acquired a cold or flu this weekend and feeling lousy. I ask your pardon if my comments on these charts is a little more curt than normal.

The Week Ahead 2019-12-29

Since bonds have held the 155^11 support for the last three weeks, I'm now leaning toward a retest of resist, say 159^24, before breaking lower in the spring.

The Week Ahead 2019-12-23

Not much change last week in bonds as it traded in the range of the week before and is still holding above the 155^11 support. I suspect a week or two of bounce before breaking lower to at least test 152^25. This correction still strikes me as a little shallow for 'c of (b)' to be complete. I also think the cycles support lower for at least another month.

Yen ETF may have started its breakdown

Many traders will be caught on the wrong footing

How much higher can stocks reach?

We chart resistance targets for the broad NYSE Composite Index

The Week Ahead 2019-12-16

Bonds have been trapped between resist at 159^24 and support at 155^11. I can't guarantee resist will not be tested again before dropping through 155^11 and at least testing 152^25. As it stands, this is too shallow to my eye for wave 'c of (b)' to be complete and cycles suggest the inflection is late January of next year at the earliest.

British Pound Futures Update 2019-12-10

Cable has been climbing since early September which was consistent with my prior count of a wave (iv) bounce but in October that count started to have problems with overlap. I think the follow EW count looks better and is at an interesting point. Here I am treating the low this year as a (b) wave and expecting a (c) wave advance for wave [iv]. You can plainly see a five wave move up from the low has taken place and now against resistance at 1.3231. At a minimum, bulls should manage, bears can begin to take a position though lower risk, but worse trade location, if they wait for a drop under 1.3028.

The Week Ahead 2019-12-08

159^24 continues to hold as overhead resist in bonds but we have yet to see them really drop away. Doubt there is much movement till after the FOMC meeting this week. I'd really like to see a test of at least 152^25 in February or March of next year.

Japanese Yen via ETF FXY 2019-12-04

Yen has dropped steadily from the wave (e) of a triangle target of 90.41. So far, no complaints as it has been on plan. FXY has tested support at 86.71 with the Lomb pulled down where it is...

The Week Ahead 2019-12-01

Bonds have been spending the last couple weeks bouncing from the most shallow of targets for c of (b). I still think it falls lower into the end of the year at a minimum and perhaps out to March.

Natural Gas via ETF UNG Update 2019-11-25

I'm looking for a higher low to form in UNG over the next couple weeks for a possible wave ii. The dominant weekly cycle is suggesting lower till the end of the year but I think we are pretty close to a window to shop for a cycle low. The daily chart looks lower to put the final touches of [C] of ii. Since this week is short due to the Thanksgiving holiday in the US, from a practical sense it makes sense to shop for a low next week.

The Week Ahead: 2019-11-25

Bonds spent last week continuing their bounce from the test of the top of the target range for wave (b). I doubt we have seen the low in wave (b) and expect bonds to press lower in future weeks though I can't guarantee bonds do not challenge overhead resists first, say 161^25.

Russell 2000 ETF struggling to meet bulls’ expectations

It still might catch up

The Week Ahead: 2019-11-17

Bonds bounced last week off the test of 156^01 which is not a problem for the case for lower into late or early next year. Best for bears that the bounce remain under 159^18.

S&P 100 still bullish

but a bear is lurking around the corner

The Week Ahead 2019-11-10

Bonds fell last week staying on plan for lower into the end of year or even out into March of next year. Bond prices are testing the top of the target range for 'c of (b)' at 156^01 but I'm not expecting much of a bounce from this level.

The Week Ahead: 2019-11-03

Theme in bonds remains lower into March of next year in a 'c of (b) of ending diagonal [v]'. Near term, think wave '[II] of c of (b)' is forming under 161^25 or 163^03 before pressing lower in '[III] of c of (b)'. Probably can use another week or two for [II] to ripen.

The Week Ahead 2019-10-27

Bonds are leaning on support at 159^18. I think it will eventually break under but may not be this week as we have the FOMC on Wednesday and the NFP number on Friday. I think the cycles argue for net lower into early next year at a minimum.

The Week Ahead 2019-10-20

Bonds are sitting on support that may cause a minor bounce but overall expecting lower into the next cycle inflection next February. An alternate count up from wave [IV] could be 'i-ii-[I]-[II]-[III]-[IV]-[V] for iii' and now forming 'iv' which implies a new high in February for 'v of (a)'. I'm not that keen on the alternate but something to keep an eye on if prices fail to drop under 159^18 after a small bounce.

British Pound futures and ETF FXB Update 2019-10-14

GBP has been on plan rising into wave (iv) targets this week. The futures have a little more room to develop if needed but the FXB chart is pretty close to the limit for a wave (iv). I have also added an alternate on the FXB chart where the drop from the wave [iv] high in 2018 is an ending diagonal where the recent low is wave (i) and is in either (ii) or 'a of (ii)' now.

The Week Ahead 2019-10-13

Bonds had a nice drop from the last chance resist at 165^11. Bears need bond prices to drop under 159^18 as confirmation that 'c of (b)' down is in development. My preference is for net lower prices into the cycle low in mid February next year.

Brazil stocks following the bearish plan

The corrective high might be set

The Week Ahead 2019-10-06

Bonds were pretty energetic last week putting stress on the idea of a lower high in 'b of (b)'. Prices are pretty much at the limit of a lower at a Gann related resistance at 165^11. Because of the strength this week, I'm starting to think a 'b' wave high is likely.

Newly refined targets for Italian stocks

along with cycles analysis

Natural Gas via UNG Update 2019-09-26

UNG has moved up to test the first weekly resist in what looks like an impulsive move and is now retracing. Will be watching 19.98 and 19.21 as possible wave ii support.

British Pound Futures Update 2019-09-26

Sterling is dropping from a typical wave (iv) resistance but I doubt wave (iv) is complete as fours are often the most complex patterns. It is conceivable that it runs sideways for months. An alternate would be this is a fourth of lower degree, 'iv', and the next low 'v of (iii)'.

The Week Ahead: 2019-09-22

Primary view in bonds is that they are bouncing in wave 'b of (b)' and the bounce last week is probably just the first part of that choppy move. The next major cycle inflection is in January next year which I suspect will be the 'c of (b)' low.

Yen responding well to resistance

The expected reversal may have begun

The Week Ahead 2019-09-15

Bonds had a nice drop this last week which conforms to the forecast for a wave (b) retrace. Since the FOMC announcement and press conference is on Wednesday afternoon, I suspect we are nearing the end of the first wave of wave (b) at 156^25 or 154^20. Difficult to forecast the end of wave (b), but should make it to at least 150^17. Probably depends on if they intend to only drop into the next cycle inflection in early November, or go for the next in January of next year. I favor the latter but we will see.

Japanese Yen Futures and ETF Update 2019-09-14

As you know, I have been critical of the rise in the Yen over the last month and continued to think it a developing wave [iv] or [b] triangle. Over the last three weeks that has been a strong reaction against resist at 0.009623. Certainly appears that prices are moving down in the early stages of [v] or [c] down out of the triangle. Supports on this chart are Gann based and while I think prices will react to them, it is very speculative at this point estimating where the turns will be in the five wave sequence. It is worth noting that the 'c of (e) of [iv] or [b]' terminated on a cycle inflection which implies a drop to the next in March of next year at a minimum and perhaps out to the following inflection next August.