US equity indices gave back gains made in the first part of last week at the end on increased tariff rhetoric but held above important areas. I know that it may be frustrating that I am not on the sky is falling bandwagon but I still think there is a good chance that the wave (iv) correction ended and we start a rise from this area for a couple months. Don't get me wrong, I think the market is headed for some very turbulent times but I don't think we have seen the high yet. We will see if they can hold steady at the start of the week and not be shocked by the FOMC minutes Wednesday afternoon.

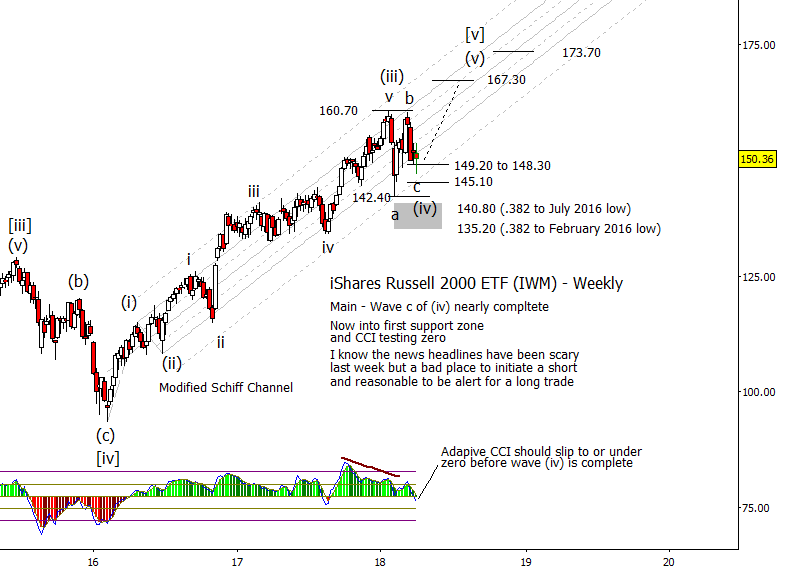

Let's start off with a bonus chart of sorts, a weekly chart of the ETF for the Russell 2000, IWM. It is resting on the top of the wave (iv) target area now and has the adaptive CCI positioned at a zero line test.

You must be logged in as a Daily Analysis or Intraday Analysis subscriber to view the rest of this post.