Consistent with our recent posts about a likely bounce in the U.S. Dollar and a corresponding decline in the British Pound, we believe the Euro is on the verge of a potentially steep drop. Traders should be prepared, because the drop may turn out to be a strong downward “middle third” wave in Elliott wave parlance.

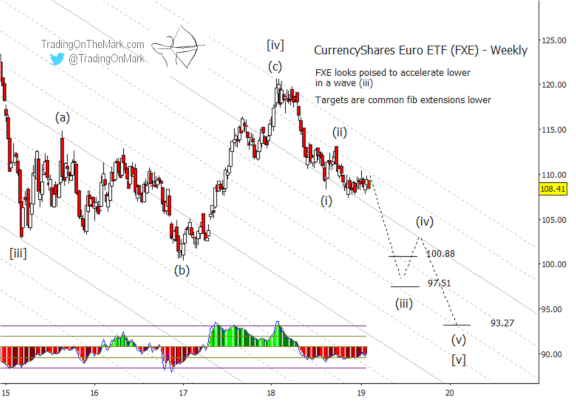

Whereas the British Pound ETF (symbol FXB) made an upward retrace into and slightly above the resistance zone we identified a few weeks ago, the CurrencyShares Euro ETF charted below (symbol FXE) merely consolidated sideways to meet a harmonic line of the downward-sloping channel.

Meanwhile the Dollar ETF (symbol: UUP) appears to be gaining upward momentum. If the Dollar breaks higher, we should start to see opposing movement in the Euro.

We’re treating the Euro’s decline from a year ago as the initial part of an impulsive fifth wave downward. In many impulsive waves, the middle part (the middle third wave) is the strongest. That phenomenon occurs slightly less often inside a larger fifth wave, but it is still reasonable for bearish Euro traders to assign the greatest probability to the scenario where downward sub-wave (iii) is stronger than the completed sub-wave (i). Some Fibonacci-related supports to aim for include 100.88 and 97.51.

The downward channel has worked reasonably well for several years on a weekly time frame, so traders should particularly watch for the intersection of support areas with channel lines as a function of time.

Follow Trading On The Mark on Twitter for more frequent updates about ETFs and futures! Also, readers of our emailed newsletter will receive exclusive opportunities to save on TOTM subscription packages.