REMINDER: Starting on Presidents’ Day weekend, Feb. 13-15, we’ll begin posting all updates at tradingonthemark.substack.com. If you’re already a subscriber to our service here, we’ll arrange to have your access continue there without interruption.

The Day Ahead: AM Edition 2021-01-20

Not much change in bonds. I think it a minor positive to hold up while the equity indices are making new highs.

First Look: 2021-01-20

S&P 500 futures staying on track by moving higher overnight.

The Day Ahead: PM Edition 2020-01-19

Bonds sticking to plan so far, working on holding a higher low.

The Week Ahead: 2020-03-01

I'm going to mix up the order a little this week as I have been working on equity indices this afternoon thus will start with them.

The Week Ahead: 2020-02-23

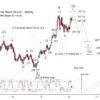

I'm adjusting my bond count up from the 2018 low from 'a-b' up in 'c of (a)' for a three wave move for (a) to one of an impulse, a five wave move. Note the areas I marked as 1) and 2) for the implications. I just can't go with the retrace from the August high as a wave (b) because it was so shallow which then implies it was a fourth and moving up in the late stages of 'v of (a) of ending diagonal [v]'. Minor target at 165^01 tested already, next at 167^23 though a retest of the prior is good enough. A drop back under previous resist at 162^28 would be first confirmation of falling back in the first swing of (b).

Japanese Yen Futures & ETF FXY Update

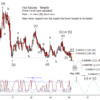

Yen appears to be accelerating lower after the minimal retrace made when I last updated this chart a few weeks ago. I'm assuming this is the early stages of (iii) of [v] or [c] down. Minor support being tested now at 0.008994 though I don't think it will be very firm. Prefer lower targets at 0.008789 or 0.008643 before a more substantial bounce.

Hit your targets

We believe an independent trader can succeed and profit in the markets, and we’re committed to helping our subscribers trade well on the time frame that best suits them. We founded Trading On The Mark in 2008 to help traders overcome some of the challenges of market analysis and trade execution. If trading futures and options based on technical analysis appeals to you, then you’re the kind of trader we want to work with.TOTM’s technical approach is grounded in Elliott wave and Gann techniques, while also making use of Fibonacci relationships in price and time, historical cycles analysis, proprietary technical indicators, and other more esoteric methods.

What people say about TOTM

If you love trading, I highly recommend Tradingonthemark! Tom, Kurt offer great charts and other technical stuff. It has improved my trading! — Moiz, intraday trader and long-time subscriber