REMINDER: Starting on Presidents’ Day weekend, Feb. 13-15, we’ll begin posting all updates at tradingonthemark.substack.com. If you’re already a subscriber to our service here, we’ll arrange to have your access continue there without interruption.

The Day Ahead: PM Edition 2020-12-10

Bonds staying on forecast by moving up on Thursday to test the moving averages and 172^19.

The Day Ahead: AM Edition 2020-12-10

Bonds have moved up from 172^01 but have yet to test 173^09.

First Look: 2020-12-10

S&P 500 futures tested critical support at 3649.75 this morning if bulls are to have another chance at a new high.

The Week Ahead 2019-03-10

I've stared at the bonds charts on and off for a few hours and is slowing me up getting this post off the ground. Maybe I should just put my thoughts to bits and explain what I have been thinking about.

Copper Update 2019-03-10

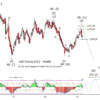

Quick update on copper. Copper has softened against resist and either set a (b) wave high or 'a of a more complex (b)'. Looking at a daily chart there is some wiggle room for a modest new high in the short term if they react strongly to support at 2.88. I have also included a chart of the copper mining ETF COPX so as to have a visual of the possible complex (b) wave alternate.

Natural Gas via UNG 2019-03-10

Back when I last updated UNG charts, I thought a bounce was due and in fact one has taken place. The question now is, was the low in February the end of the pattern down from the November high from last year or is there one more low left? I favor the latter because fourth waves typically have a complex wave form and we have yet to a new low or test of the 2017 low. For timing, thinking the best time for a low is late March or early April, even it turns out to be a higher low.

Hit your targets

We believe an independent trader can succeed and profit in the markets, and we’re committed to helping our subscribers trade well on the time frame that best suits them. We founded Trading On The Mark in 2008 to help traders overcome some of the challenges of market analysis and trade execution. If trading futures and options based on technical analysis appeals to you, then you’re the kind of trader we want to work with.TOTM’s technical approach is grounded in Elliott wave and Gann techniques, while also making use of Fibonacci relationships in price and time, historical cycles analysis, proprietary technical indicators, and other more esoteric methods.

What people say about TOTM

If you love trading, I highly recommend Tradingonthemark! Tom, Kurt offer great charts and other technical stuff. It has improved my trading! — Moiz, intraday trader and long-time subscriber