REMINDER: Starting on Presidents’ Day weekend, Feb. 13-15, we’ll begin posting all updates at tradingonthemark.substack.com. If you’re already a subscriber to our service here, we’ll arrange to have your access continue there without interruption.

The Day Ahead: PM Edition 2020-10-19

Bonds dropped under 174^16 today to test deep wave II support and made an attempt to recover.

The Day Ahead: AM Edition 2020-10-19

Bonds still trying to base for a wave II against support at 174^03.

First Look: 2020-10-19

S&P 500 futures rose up on the Sunday evening open in accord with the theme of the wave [II] retrace becoming more complex.

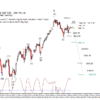

Natural Gas (via UNG) 2017-08-28

Updated weekly chart but very little change from the earlier post here which you should read as a reminder of the possibilities. The most noteworthy difference is that the cycle detection is focusing on a shorter cycle which has the ideal low at the end of September.

Consumer Discetionary ETF (XLY) 2017-08-26

I know that I just posted these last week but made slight changes to the targets on the weekly chart and think that the broader market is on the same path, closing in on a summer low.

Consumer Discretionary ETF (XLY) 2017-08-19

XLY is on plan correcting as expected. Can use a little lower over the next week or three to test ♦♦.♦♦ to ♦♦.♦♦ after which we see if they can muster enough energy to push to a new high, the main scenario, or if any bounce sets a lower high, the alternate.

Hit your targets

We believe an independent trader can succeed and profit in the markets, and we’re committed to helping our subscribers trade well on the time frame that best suits them. We founded Trading On The Mark in 2008 to help traders overcome some of the challenges of market analysis and trade execution. If trading futures and options based on technical analysis appeals to you, then you’re the kind of trader we want to work with.TOTM’s technical approach is grounded in Elliott wave and Gann techniques, while also making use of Fibonacci relationships in price and time, historical cycles analysis, proprietary technical indicators, and other more esoteric methods.

What people say about TOTM

If you love trading, I highly recommend Tradingonthemark! Tom, Kurt offer great charts and other technical stuff. It has improved my trading! — Moiz, intraday trader and long-time subscriber