Expect a reversal in treasuries soon

Don't be fooled by the steep rise

Newsletter: Expect a reversal in treasuries soon

With the FOMC meeting this week, the price of long-term treasuries is reaching our target area at an interesting time. This edition of the free newsletter from Trading On The Mark offers readers an...

Newsletter: T-bonds reaching the end of their bounce

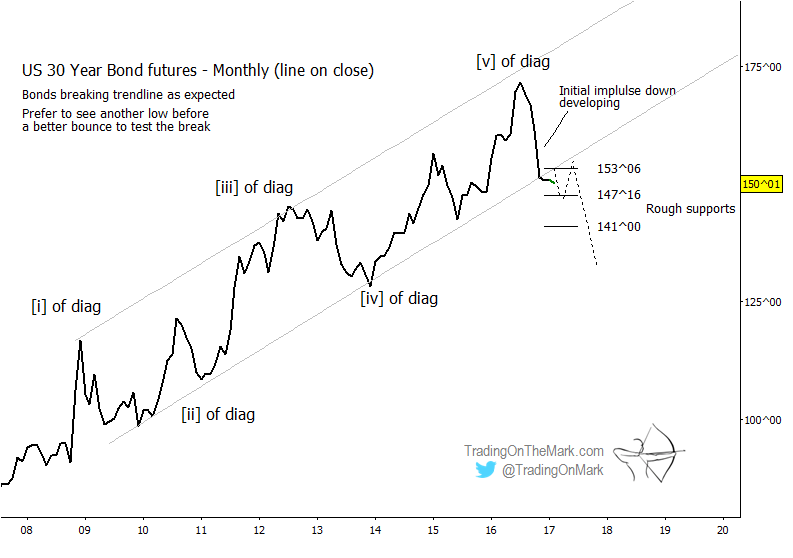

The bearish scenario for treasury bonds that we described in September and again in October appears to be on track. This edition of the free TOTM newsletter shows some upward targets that nimble...

How much longer can T-bonds keep rising?

Is your seat belt fastened?

Will stocks or bonds stumble first?

One of them is likely to recover its footing

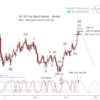

iShares 20+ Treasury Bond ETF (TLT) 2017-10-01

As you would expect, the analysis here is very similar to that done on bond futures earlier. This looks like a wave (ii) bounce though it is too early to rule out another test of overhead resistance.

Trading the next move in treasuries

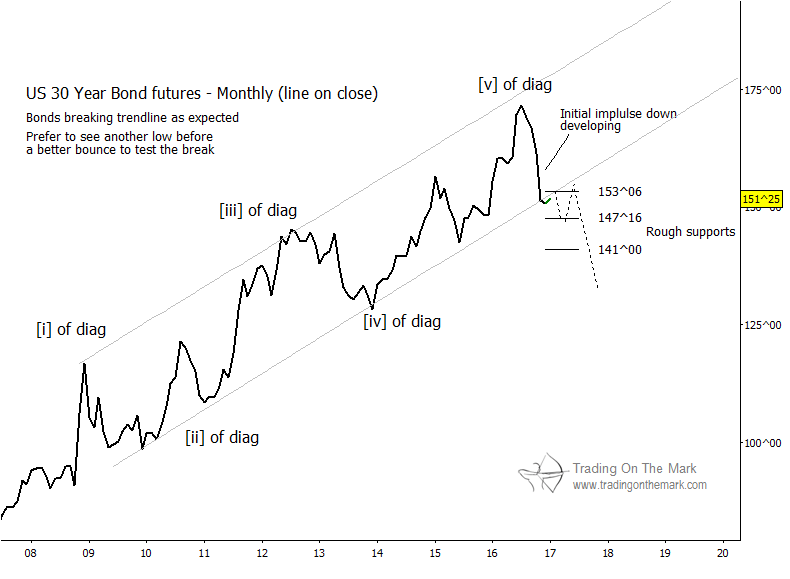

The choppy rise from the turn of the year appears to have been corrective, in this case meaning that it should be treated as a retracement.

Scouting for the next moves in treasury bonds and gold

February 2017 bulletin from Trading On The Mark

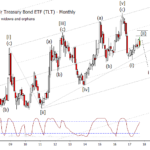

iShares 20+ Yr Treasury Bond ETF (TLT)

The short trade in TLT is certainly long in the tooth but looking for a new low, as in bonds, before a better bounce. The monthly chart is counted out the same as bonds, a large ending diagonal...

Review and forecast for treasury bonds and TLT

The big-picture pattern in treasury bonds has been working well for several years and has allowed us to predict some major inflections. There are however signs that treasuries and the iShares Barclays 20+ Year Treasury Bond ETF (NASDAQ:TLT) may be ready to move into an entirely new phase. Here we take a quick review of our performance with TLT in 2016 before considering where treasuries should go next.